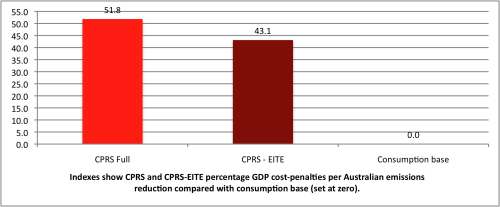

Chart 2 below summarises the report’s 2020 results for Australian emissions production.

The full CPRS is about 52 per cent more expensive than the consumption model. The Government’s CPRS-EITE model is about 43 per cent more expensive.

Rounded, Charts 1 and 2 say the same thing.

Advertisement

Why such large differences?

Chart 2. Cost-penalty indexes, CPRS, CPRS-EITE and consumption bases, 2020

Source: Based on Access Economics’ preliminary modelling results for CEDA (derived from Report Table 4.2, page 15).

The CPRS and CPRS-EITE policies work like taxes on production. They apply to business inputs, cascading and compounding all the way down the supply chain. They also work a bit like State stamp duties or “turnover taxes” (currently high-priority targets for abolition as part of the Henry Tax Review). This approach is inefficient and distorting, with large economic (“deadweight”) costs.

The consumption approach avoids these production efficiency losses. Doing the same emissions reduction job with smaller output and jobs losses is lower-cost.

Advertisement

There’s more. The consumption policy is even more effective in reducing global emissions than the CPRS. It eliminates the CPRS “carbon leakage” problem arising from taxing our emissions exports and effectively subsiding our emissions imports, driving activity to non-regulated emissions locations offshore.

Including these global effects, the full CPRS and CPRS-EITE models are, respectively, about 77 per cent and 62 per cent more costly than the consumption policy. See Chart 3.

Should a consumption model replace the CPRS? Maybe - it appears cheaper - but not without more analysis.

Discuss in our Forums

See what other readers are saying about this article!

Click here to read & post comments.

6 posts so far.