Would a climate policy 50 per cent cheaper than the CPRS (Carbon Pollution Reduction Scheme) be worth a closer look?

An Access Economics report (Preliminary economic modelling of a national consumption-based approach to greenhouse gas emission abatement, August 24, 2009) compares the CPRS (targeting Australian greenhouse gas emissions production) with a policy targeting Australian emissions consumption. “Production” includes our emissions exports but not imports. “Consumption” includes our emissions imports but not exports.

Three options are compared:

Advertisement

- a no-concessions CPRS (labelled “CPRS full”);

- the Government’s CPRS including concessions for the “emissions intensive trade exposed” sector (labelled “CPRS-EITE”); and

- emissions consumption with no concessions (labelled “consumption base”).

The policies’ economy-wide effects are quantified using a global computable general equilibrium model, similar to those used by Treasury. It assumes Australia acts unilaterally, with no international trading of emission permits. The authors stress it’s a preliminary contribution to the debate, not an endorsement of the consumption approach.

The report shows reducing emissions by pricing them comes with economy-wide costs and reduced emissions benefits. The least-cost option is the target of “good policy”.

Modelling results can be summarised two ways. The first shows emissions reduction for a given cost (e.g., a reduction in GDP or job losses).

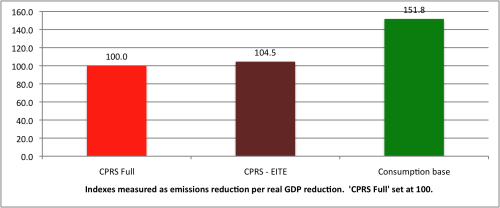

Chart 1 reports the findings expressed this way for 2020. For reducing Australian emissions production, the consumption-based policy is almost 52 per cent more efficient than the full CPRS, (and more than 45 per cent more efficient than the CPRS-EITE), assuming the same carbon price.

Chart 1. Cost-effectiveness emissions reduction indexes, CPRS and consumption bases, 2020

Advertisement

Source: Based on Access Economics’ preliminary modelling results for CEDA (derived from Report Table 4.1, page 14).

The second measure quantifies Australian cost penalties (e.g., extra losses of output and jobs) for a given emissions reduction under different policies (assuming the same carbon price).

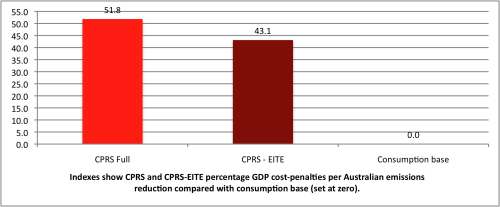

Chart 2 below summarises the report’s 2020 results for Australian emissions production.

The full CPRS is about 52 per cent more expensive than the consumption model. The Government’s CPRS-EITE model is about 43 per cent more expensive.

Rounded, Charts 1 and 2 say the same thing.

Why such large differences?

Chart 2. Cost-penalty indexes, CPRS, CPRS-EITE and consumption bases, 2020

Source: Based on Access Economics’ preliminary modelling results for CEDA (derived from Report Table 4.2, page 15).

The CPRS and CPRS-EITE policies work like taxes on production. They apply to business inputs, cascading and compounding all the way down the supply chain. They also work a bit like State stamp duties or “turnover taxes” (currently high-priority targets for abolition as part of the Henry Tax Review). This approach is inefficient and distorting, with large economic (“deadweight”) costs.

The consumption approach avoids these production efficiency losses. Doing the same emissions reduction job with smaller output and jobs losses is lower-cost.

There’s more. The consumption policy is even more effective in reducing global emissions than the CPRS. It eliminates the CPRS “carbon leakage” problem arising from taxing our emissions exports and effectively subsiding our emissions imports, driving activity to non-regulated emissions locations offshore.

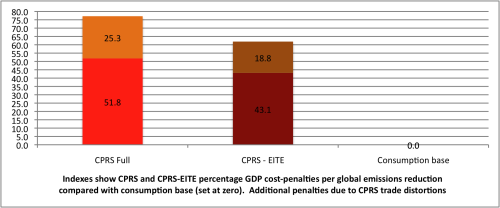

Including these global effects, the full CPRS and CPRS-EITE models are, respectively, about 77 per cent and 62 per cent more costly than the consumption policy. See Chart 3.

Should a consumption model replace the CPRS? Maybe - it appears cheaper - but not without more analysis.

The Senate Select Committee on Climate Policy wanted modelling answers for all six options it discussed (CPRS included). This is prudent (i) to ensure we have the lowest-cost policy, and (ii) to ensure all models are transparent and peer-reviewable.

The preliminary Access Economics analysis is aimed at this wider debate. The authors note that more work is needed.

I suggest three reasons why the consumption model should be considered as one option in this wider debate.

First, preliminary modelling suggests it could be 50 per cent more cost-effective than the CPRS in reducing Australian greenhouse gas emissions (see Charts 1 and 2).

Second, it should be even cheaper in reducing global greenhouse gas emissions than the CPRS, because, unlike the CPRS, it also reduces Australian imports of such emissions and eliminates “carbon leakage” from Australia (see Chart 3).

Third, by eliminating “carbon leakage” (due to lost trade competitiveness) as a reason not to act, this model could be a template for all countries. By eliminating trade competitiveness concerns, it greatly improves chances of securing a global deal.

This third consideration is crucial.

Without a global deal, Australia’s efforts to reduce its own emissions (no matter how large or small) matter little in the global scheme of things.

We’re too small on the absolute emitters scale.

Chart 3. Cost-penalty indexes, CPRS, CPRS-EITE and consumption bases, 2020, global effects

Source: Based on Access Economics’ preliminary modelling results for CEDA (derived from Table 4.2, page 15).

In the next couple of months, how about a thorough quantitative analysis managed by the Productivity Commission, incorporating the best modelling available (private and public), covering the range of policy options considered by the Senate Select Committee?

We have time to get it right. We’re not debating emissions reduction targets here. We’re just looking at how best to hit them.

We’ll have plenty of time to regret our mistake if we get the policy design wrong.