Australia has a reputation as being the “lucky country”. I am a firm believer that “luck” is simply where preparation meets opportunity. In other words, being lucky is no accident. If we are to remain the “lucky country” however, we need to adapt as circumstances change. Nowhere is this more pertinent than in adapting to Australia’s future oil supply.

Before we start considering this issue, it is vitally important to understand why energy is so important to our economy. Energy is important because it allows us to do work. Work is important because it is the basis of all economic activity. So the more energy we have, the more work that can be done and the greater the level of economic activity. If we continue to expand the amount of energy that is available then so too will the level of economic activity, resulting in what we call growth.

Of course, the opposite situation is also true. If the available energy declines, the amount of work that can be done declines as does economic activity. The result is economic contraction or what is commonly called a recession or depression.

Advertisement

Oil just happens to be both Australia’s and the world’s primary energy source. With this in mind, let’s have a look at Australia’s likely future oil supply.

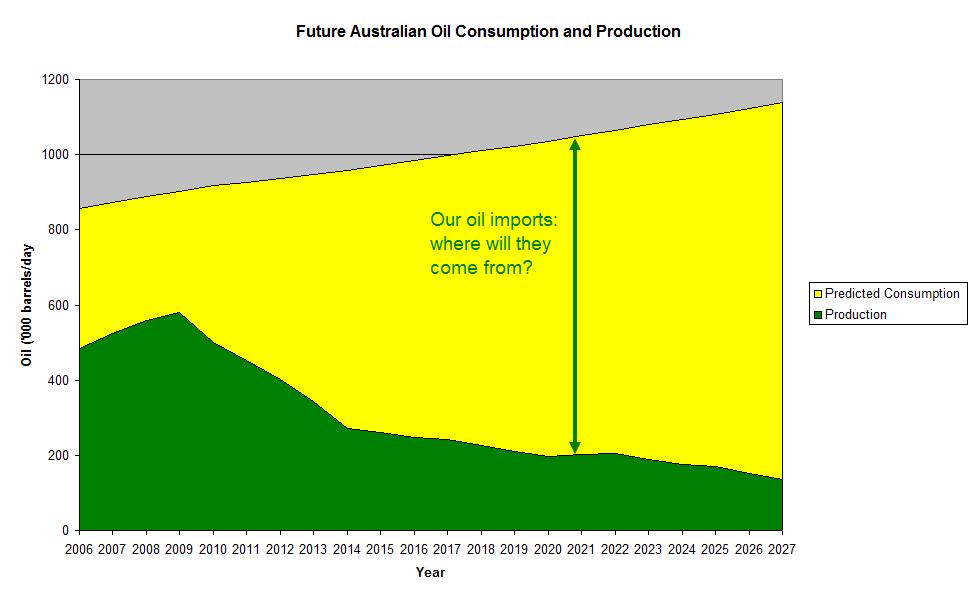

Chart one details ABAREs projection for Australian oil consumption and Geoscience Australia’s predictions of Australian oil production. The chart shows that Australia will become increasingly dependant upon oil imports, potentially reaching a reliance of 85 per cent by 2025.

Chart One: Australia’s projected oil consumption and production. Data sourced from here (PDF 35KB).

Where will this oil come from? There are a number of factors that make it unlikely that Australia will be able to import this quantity of oil. These include:

- continued growth in demand for oil, particularly from nations such as China and India;

- the majority of the world’s oil producing nations are past their domestic peak in oil production. This includes the majority of OECD nations which are net oil importers and will have an increasing call on oil imports as their domestic production declines; and

- many oil exporting nations are also past their peak in oil production. Combined with increased domestic consumption, this results in a rapid decline in oil exports.

Advertisement

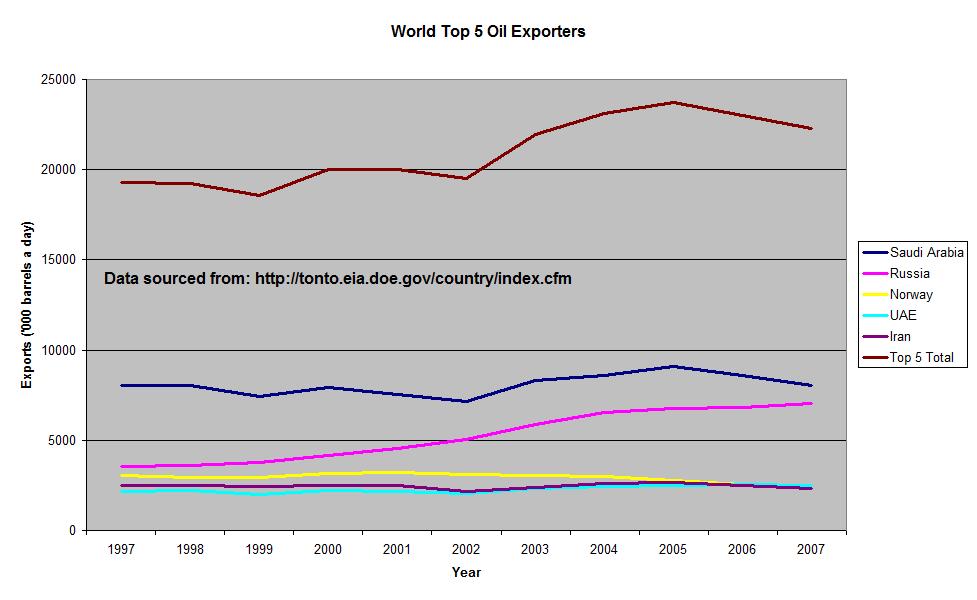

The net result is that the quantity of oil available for Australia to import in the future will decline. Chart two, prepared using data from the US Government’s Energy Information Administration (EIA) shows that oil exports from the world’s top five oil exporters are already in decline, as are the exports from those countries that Australia imports the majority of its oil from (table one).

Chart two: oil exports from the world’s top five oil exporters

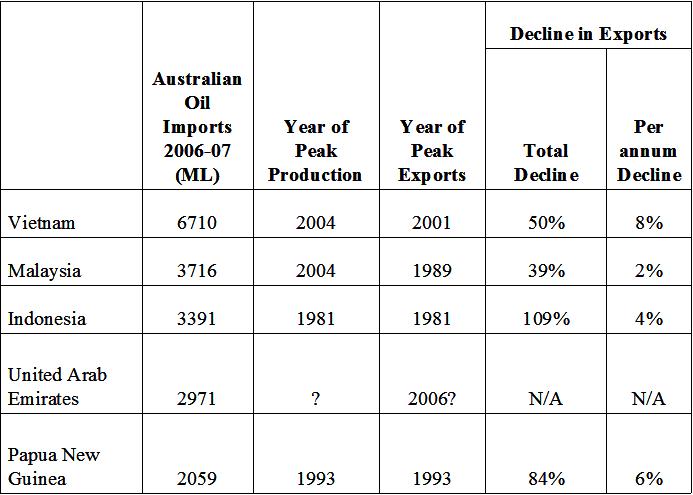

Table One: export situation of top five countries that Australia imports oil from. All data sourced from here.

Two oil analysts who have been investigating declining oil exports suggest that the average rate of decline in oil exports from the top five oil exporters will be 6.2 per cent +/- 4 per cent per annum. With demand for oil imports growing, this situation will likely result in demand destruction, higher oil prices and physical shortages.

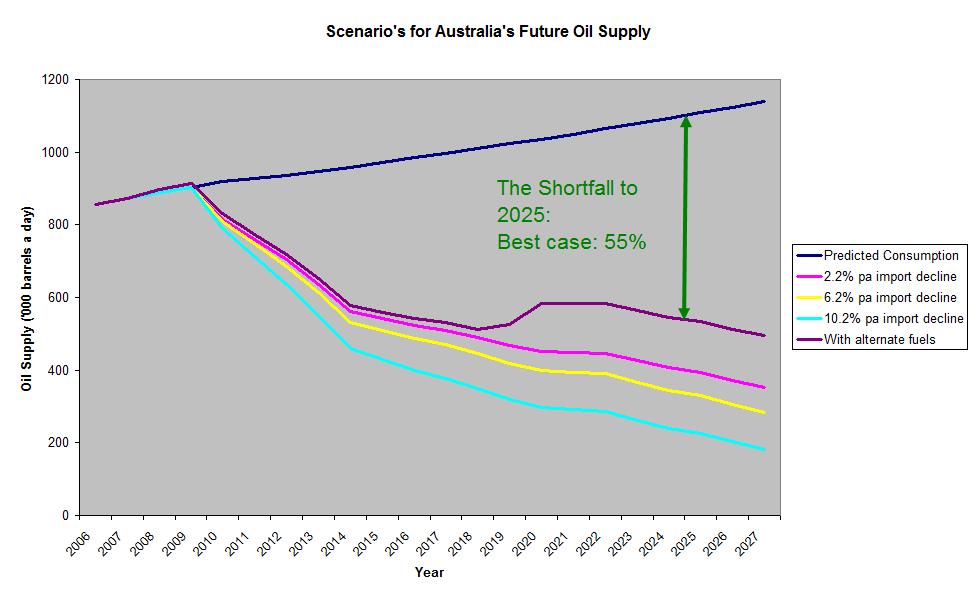

Australia’s oil supply consists of our domestic oil production and oil imports. Combining Geoscience Australia’s prediction for future Australian oil production with imports declining at 6.2 per cent +/- 4 per cent per annum provides three indications of Australia’s future oil supply, as shown in chart three. There are a number of assumptions used in developing this model, they are:

Australia imports limited oil from the world’s top five oil exporters. However the production from large oil producing regions declines at a slower rate than smaller oil producing regions. Therefore applying the 6.2 per cent +/- 4 per cent pa decline rates is likely to be a more optimistic decline rate than that which will apply to Australia’s major oil providers. This is further supported by the annual percentage declines in exports from Australia’s major oil providers shown in table one.

That Australia can import its current percentage of the world’s declining oil export base. There is and will continue to be intense competition from all oil importing nations for the declining world oil export base. This includes the majority of OECD nations and rising powers such as China and India. Maintaining this percentage will be a very difficult task to achieve.

The model does not account for geopolitical factors that could reduce oil available for export. Examples of such factors include civil unrest in oil exporting nations, war, bilateral arrangements, such as those recently signed between Russia and China, and exporters deciding to produce less oil in order to maximise their profits and save oil wealth for future generations, as Saudi Arabia is doing.

Does not include alternative fuels. However according to the Commonwealth Government’s National Energy Security Assessment, these are unlikely to be more than niche fuels out to 2023 (the latest forecast prediction) and therefore are unlikely to make more than a minor contribution to Australia’s fuel supply.

Does not consider the cost of oil. It is likely that the oil will become increasingly volatile and costly, continuing the trend of the last five years. Indeed there have been numerous comments from the International Energy Agency and other organisations warning that the current oil price and reduction in credit as a result of the global financial crisis will result in another oil price spike when demand for oil recovers.

It only considers the net difference between consumption and domestic production. Australia exports a large percentage of its oil production due to a combination of the location of its oil fields and the grades of oil they produce. Australian refineries are optimised for different grades of oil, therefore our dependence on imported oil is actually higher than that indicated in chart one.

Chart three: scenario’s for Australia’s future oil supply.

Chart three is a sobering assessment of Australia’s future oil supply and raises a number of questions about current policy and the future of the “lucky country”. These questions include:

- how effective will Government “stimulus packages” be that do not consider this problem?;

- can economic growth be maintained as the availability of our primary energy supply declines? Do we need another economic model?;

- how will our transportation systems work if the population grows but the amount of oil available halves?;

- how will we feed a growing population as oil supplies decline?;

- why are investments in public transport a poor cousin to car based infrastructure?;

- what is the future of industries such as aviation, tourism and automotive?; and

- what worth will superannuation have in the decades ahead?

The answers to these questions are fundamental to the future of Australia. The magnitude of the changes required to adapt to a declining oil supply imply a cost measured on a billion dollar scale and time measured in decades. Yet this issue barely rates a mention in most forums of public debate. Unless we collectively come to terms with this problem, and quickly, it is hard to see the “lucky country” remaining lucky for much longer.