In truth, the Henry Review Committee, which is to report to government by the end of the year on reform of Australia’s system of taxes and social security payments, faces an enormous list of potential reform options for adoption over the next year or two or over some decades.

One way to categorise the reform options is to evaluate the different tax bases or taxable sums, the tax and payment rate schedules attached to each base, the mix of tax bases, and then some of the options for changes. Under broad political constraints of an aggregate revenue neutral package of changes that maintains approximate vertical equity in redistribution, this article considers reform options that could reduce distortions of the income transfer system to decisions on work, investment and so forth, that would simplify the system and reduce costs of compliance, and changes to improve horizontal equity.

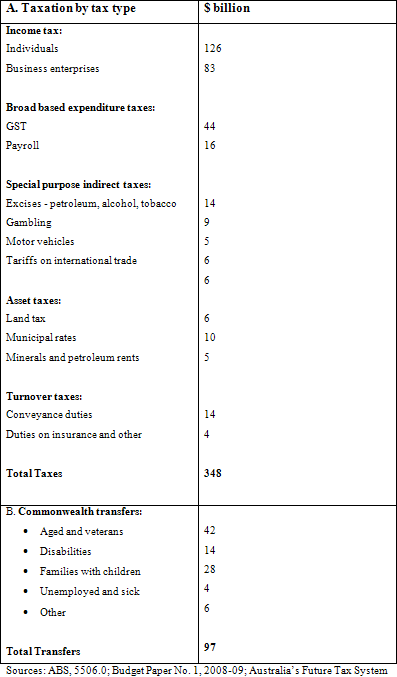

Table 1 provides a broad overview of Australia’s income transfer system in terms of broad tax base categories levied by the commonwealth, state and local governments, and of social security payments paid by the commonwealth government.

Advertisement

In 2007-08 total tax revenue of $348 billion represented 30.8 per cent of national income. They provide revenues, or access to labour, capital and other resources, to provide public goods such as law and order and defence, to fund public provided education, health and housing, and for redistribution to achieve society goals of equity. Direct income payments to the aged, those with disabilities, families, the unemployed and others are the most important source of income for about a third of Australian households. In 2007-08, $97 billion was redistributed.

Table 1: Main Taxes and Social Security Payments, Australia 2007-08

Income tax accounts for about 60 per cent of aggregate tax revenue. It is collected directly on individuals and as a withholding tax on business enterprises (including corporations and superannuation funds).

The ideal income tax base, or taxable sum, includes all forms of labour remuneration, and the returns on all investments in financial deposits, shares and property. In practice the current income tax system has many special exemptions and deductions, often referred to as tax expenditures, which reduce the tax base below its potential.

Treasury in its Tax Expenditure Statement 2008 reports tax expenditures of about $55 billion in foregone income tax revenue. Examples include concessional tax rates for remuneration taken as fringe benefits and lump sums, tax rebates for those in remote regions, a halving of the tax rate for capital gains, and concessions for savings invested in superannuation and in owner occupied homes, and concessions for some business investments.

Advertisement

A very significant income tax reform would remove the special exemptions and deductions for particular categories of income and treat a dollar of income as a dollar regardless of the form of labour remuneration or of the form and place of investment. A comprehensive income tax base would reduce distortions to decisions and increase national productivity, it would provide for greater horizontal equity, and it would contribute to a simpler tax system with few incentives for wasteful tax avoidance schemes. Also, and as a key part of a reform package, the sticks of a broader base would fund the carrots of lower tax rates while collecting the same revenue.

Several reforms to the progressive income tax rate schedule could be considered. Automatic indexing of the tax brackets each year for inflation would eliminate the income tax share of the economy rising with inflation, and force greater honesty on government “tax cuts”. The current rate schedule would be more transparent and simplified by incorporating the low income tax offset and senior Australians tax offset in the schedule rather than as ad hoc add-ons. Similarly, removing the complex Medicare levy with its contribution to a zone of high effective marginal tax rates would simplify income taxation.

Australia has two potential broad based taxes with a similar economic incidence on consumption expenditure. The goods and services tax (GST) falls on income spent and exempts income saved, and the payroll tax falls on labour income and exempts capital income which is the return on saving. More comprehensive and broader tax bases, for example following the New Zealand example for the GST and removing the small firm exemptions for payroll tax, with the revenue gain used to fund lower rates or to reduce other more distorting taxes, would improve national productivity and simplify the taxes.

Relative to the income tax and social security payments systems, exemptions from the GST and payroll taxes are far less direct and effective ways of meeting society equity objectives.

An important area of the taxation reform debate facing the Henry Review Committee concerns the mix of income and consumption taxes. Australia is relatively more reliant on income taxation than most other countries.

A key reform option is whether there should be a lower effective tax rate on capital income, and not just a lower corporate tax rate, than on labour income. The analytical supporting argument for such a tax mix change rests on the observations that Australia is a small and open economy with the result that the supply of capital to Australia, including borrowing from overseas, is much more elastic or price responsive than is the supply of labour. In this context, most of the final economic incidence of taxation of capital, and of labour, falls on the relatively fixed supply input labour, and that in the longer run the size of the economy and real wage rates can be increased with a relatively low tax rate on the more mobile factor capital.

In principle there are compelling arguments for special and additional taxes on particular expenditure items to correct market failures. However, the current Australian special purpose indirect taxes on petroleum products, alcohol, tobacco, gambling and motor vehicles are poorly designed.

A special tax to increase the price of products whose consumption or production results in external or spill over costs on third parties internalises these external costs, reduces production and consumption, and brings gains in economic efficiency. For example, an appropriate tax on the external costs of criminal activity, road accidents and extra health costs associated with excessive alcohol consumption is a common rate per unit of alcohol by volume on all alcohol beverages, not the current ad hoc set of different rates on different beverages and even different rates by form of beverage container.

Special taxation of the use of motor vehicles is justified on efficiency grounds as a user charge for government provided road infrastructure, as a charge on the external costs of local and global pollution, and as a way of internalising the costs of congestion in the big cities during peak hour travel.

With no general annual wealth tax or a set of taxes on bequests and gifts, Australia differs from many other OECD countries, although such taxes are not large revenue raisers.

The current land tax base is far from comprehensive and its current progressive rate schedule is more a means of tax avoidance and unnecessary complication than an effective vertical equity instrument.

Replacement of the state royalties per tone or dollar of product on mining with a profit-based resource rent tax would achieve significant gains in economic efficiency with no revenue loss. Further, one reform option is to increase the relative importance of resource rent taxes on energy and minerals, and perhaps to extend its application to water and other natural resources, and then to use the revenue gains to fund reductions in other more distorting taxes on labour and capital incomes.

Stamp duties on the transfer of commercial and residential property and stamp duties on insurance are old fashioned revenue raising turnover taxes imposed by the states. They should be high on the list for replacement with less distorting taxes. The transfer duties restrict the transfer of property from less valued to more valued uses, and they hinder productivity growth and adjustment to changing household and business circumstances. Their replacement with annual taxes, such as an augmented land tax or an annual wealth tax, would have similar long run economic tax incidence effects, but with a gain in efficiency. Stamp duties on insurance, in addition to the GST, do not correct any market failure, but rather they increase the cost of desirable risk management strategies.

The extensive set of social security payments for the aged, the disabled, the unemployed and families is an important component of the Australian income transfer system to be considered by the Henry Review Committee. Rates of payment and their indexation, the means testing of these benefits, and their inter-relationships with the tax system are all important topics for reform evaluation.

For example, the current set of multiple supports for families, including the baby bonus, Family Tax Benefit (A), Family Tax Benefit (B), and subsidies and tax concessions for child care, is complex and their interaction with the income tax system results in effective marginal tax rates exceeding 50 per cent falling mainly on women who have relatively high elasticities of labour supply. Reform options include a single family support measure justified to achieve horizontal equity and to recognise the external benefits of children to society, and making the support measure a universal non-means tested payment.

Commonwealth-State financial relations, both on the expenditure side as well as on the revenue side, continue as a lively area of policy reform debate. On the revenue side, policy options under discussion include reductions in the extent of vertical fiscal imbalance whereby the commonwealth collects about 80 per cent of the revenue but the states account for nearly a half of government expenditure, the appropriate levels of horizontal fiscal equalisation under which the smaller states receive larger commonwealth tax transfers per capita than the larger states, and greater harmonisation of tax bases across the states to improve simplicity and to reduce costs.

A summary theme of my proposals for reform of the Australian tax system is to have broad and comprehensive tax bases, with bases for income and consumption and with the more controversial option of a base for wealth or assets, by removing the many current special tax exemptions and deductions. The revenue gains would be used to fund lower tax rates and removal of the transaction taxes. Special taxes designed to correct market failures would complement the broad based general taxes.