Whether renting or buying it is certainly getting dearer to get a roof over our heads. The reason is simple. House prices are growing faster than incomes. In colder mathematical terms international surveys leave little doubt that housing in Australia is unaffordable.

Demographia found Australia the least affordable of the six western countries it surveyed (Australia, New Zealand, United States, Canada, United Kingdom, Ireland) in both 2007 and 2009. In 2009, for example, it listed all capital cities in Australia as “severely unaffordable” (the worst category). No Australian city was “affordable”. The measure used was the Median Multiple Test: the number of years of the median household income it takes to buy the median priced home. At 9.6 the Sunshine Coast had the dubious distinction of being the worst of the “severely unaffordable” areas. The Gold Coast was little better.

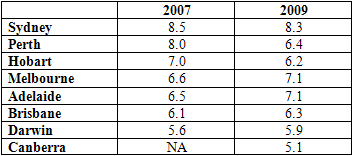

Overall, Queensland was mentioned no less than nine times in the 60 least affordable markets. Table 1 shows where each of the capital cities stood in 2007 (at the height of the “housing bubble”) and in 2009.

Advertisement

Table 1: Median multiples for Australian capital cities

(Severely unaffordable” refers to a Median Multiple of 5.1 and over. A Median Multiple of 3 is taken to be “affordable”.)

Yet the picture is worse than this. For one thing the median household income is now usually two incomes. Then again there is the effect of interest charges. For example, an affordable house bought in 2007 at a Median Multiple of 5 with interest of 6.5 per cent over 30 years was really equivalent to buying a house with a Median Multiple of 12 (2007, p.13).

Changing terminology

Despite its persistence no progress has been made in improving housing affordability. One thing that makes it more difficult is the incorrect terminology.

The best way to begin to understand the problem is to compare the least affordable and the most affordable places in Australia. Mosman in Sydney and Cottesloe in Perth may well be the least affordable places in Australia. Each has a median house price of about $2 million. By contrast, the most affordable place in Australia is the municipality of Central Darling in far western New South Wales. Its median house price is $39,000. To put it bluntly, waterside Mosman and Cottesloe, lying between the CBD and the beaches, enjoy the best that nature and society have to offer, the other has almost the worst.

Advertisement

Very simply, the difference is location. This suggests that, if we truly wanted to understand the problem, we should replace housing unaffordability by land unaffordability. Housing construction costs are not the problem. Land price is the problem.

The land price cycle

Some say that you can set your investment clock by an 18-year cycle: four years to adjust to one “bust”, followed by seven years of moderate growth and then seven more years of frantic speculation. Near the end the wise investor “cashes up” and takes a holiday!

How this speculation typically works was let slip by a local real estate agent when it was rumoured that Alcoa would soon be moving into Portland, Victoria in 1980. He wrote “people just went mad and there was huge land activity for weeks … Speculators bought up big and investors …pulled their properties off the market to wait for higher prices. Three hundred blocks of land … were immediately withdrawn from the market as the demand increased”.

Discuss in our Forums

See what other readers are saying about this article!

Click here to read & post comments.

41 posts so far.