Oil exports are likely to continue to decline as these nations are post peak oil production and their domestic consumption is increasing. The oil wealth generated through oil exports encourages increased domestic consumption while reducing oil available for export. This situation is replicated among many of the world’s oil exporting nations.

Based on EIA data, it appears that exports from the world’s top 15 oil exporters, who provide more than 90 per cent of world oil export’s may have peaked in 2005. If world oil exports are in a terminal decline and demand for oil imports increases, clearly there is going to be an issue with sourcing imports.

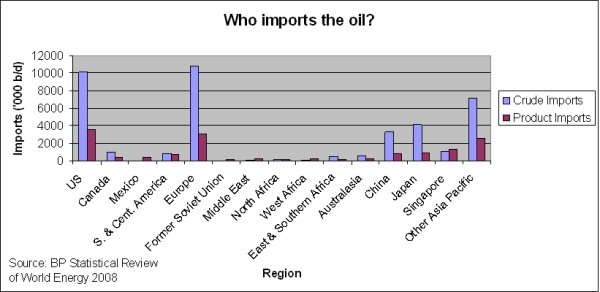

Both the LFVA and NESA avoid this significant problem by stating that the diversification of oil supply sources is important without identifying that all oil importers will be attempting to diversify supply sources. The competition for oil exports will be intense and leads to the next issue: geopolitics.

Advertisement

The competition: Australia is a minor player in the oil import game. The competition will be intense to “diversify” supply

The NESA states that the “longer term outlook for liquid fuel security will see increasing reliance on difficult geographic and geopolitical regions. This may result in price volatility.” While price volatility is of concern, this statement significantly understates the potential for geopolitical problems resulting from dependence on oil imports. Former US Air Force Intelligence Officer, Jeff Vail, has identified a number of geo-political feedback loops that will exacerbate the problem of declining oil exports.

A summary of the major feedback loops are:

Return on investment

Increased scarcity of energy, as well as increased prices, increase the return on investment for attacks on energy infrastructure. This already occurs in many countries including Nigeria, Iraq, Yemen and Mexico. For example, a 2007 attack on natural gas pipelines in Mexico was estimated to have a return on investment of 1.4 million per cent.

Mercantilism

Declining oil exports will encourage nations to guarantee sources of supply through long term supply deals. China is particularly aggressive in this regards, signing recent deals with Brazil and Russia to secure long term oil supplies and investing in energy companies around the world. Energy mercantilism will further reduce the amount of oil available for importation and encourage other countries to lock up long term supplies. Another option is military adventurism.

Advertisement

Nationalism

Nigeria is a forced amalgamation of numerous distinct ethnic groups. Nigeria’s oilfields however are only found in a small number of provinces. This poses a difficult problem. Nigeria as a nation state has an ownership claim on the oil reserves within its borders, but so do the traditional land owners. Add corruption and inequal distribution of oil wealth and the situation is ripe for internal conflict. The Movement for the Emancipation of the Niger Delta (MEND) has significantly reduced Nigerian oil exports as they attack oil infrastructure to further their political objectives. As oil exports decline and thus the wealth from oil exports decline, this problem will become more prevalent.

These feedback loops will reinforce each other and impact globally. For example Mexico will soon turn from major oil exporter to net importer. This will increase the scarcity of oil exports around the world exacerbating both the likelihood and impact of the other feedback loops. It is difficult to forecast exactly how geopolitical feedback loops will impact upon Australia’s liquid fuel security but it is reasonable to expect that declining oil exports combined with geopolitical feedback loops will have a negative impact on Australia’s oil supply. There is another feedback loop however that deserves a section on its own, and that is oil industry investment.

Investment

The International Energy Agencies (IEA) World Energy Outlook 2008 stated that there is a “real risk that under-investment will cause an oil-supply crunch” before 2015. This was prior to the full impact of the global financial crisis. A recent report (PDF 424KB) from the IEA suggests that global energy sector investment will fall by 21 per cent in 2009 with projects the equivalent of 6.2 million barrels a day, around 8 per cent of current world oil production, being cancelled or delayed. The Economist warns that investment shortfalls will result in another oil price spike when global demand for oil recovers.

Discuss in our Forums

See what other readers are saying about this article!

Click here to read & post comments.

6 posts so far.