Introduction

An election commitment of the Rudd Labor Government was to develop an assessment of Australia’s future energy security. This resulted in the release of the National Energy Security Assessment (NESA) in March 2009. The liquid fuels section of the NESA was largely based on the findings of ACIL Tasman’s Liquid Fuel Vulnerability Assessment (LFVA).

Given the importance of liquid fuels to both the global and Australian economy, it is reasonable to expect that the Australian Government would provide a realistic appraisal of Australia’s future liquid fuels security. Both the LFVA and the NESA fail to address key questions resulting in a liquid fuels security assessment that is unduly optimistic. This post will explore the key weaknesses of the NESA and propose an alternative, more realistic assessment of Australia’s liquid fuels security.

What is energy security?

The Department of Resources Energy & Tourism defines energy security as the adequate, reliable and affordable supply of energy to support the functioning of the economy and social development, where:

Advertisement

- adequacy is the provision of sufficient energy;

- reliability is the provision of energy with minimal disruptions to supply; and

- affordability is the provision of energy at a price which does not adversely impact on the economy and supports investment in the energy sector.

The NESA further defines the level of energy security using classifications of high, moderate and low. The definitions are:

- low is when the needs of Australia are not, or might not be met;

- moderate is when the needs of Australia are being met, however there are issues that will need to be addressed to maintain this level of security;

- high energy security is when the needs of Australia are being met.

Australia’s liquid fuels security out to 2023 according to the NESA is shown below:

| |

Current |

2013 |

2018 |

2023 |

| Adequacy |

High |

High |

High |

Moderate |

| Reliability |

High |

High |

High |

Moderate |

| Affordability |

Moderate |

Moderate |

Moderate |

Moderate |

| Overall |

High |

High |

High |

Moderate |

Advertisement

Analysis inadequacies

The NESA acknowledges that Australia’s dependence on oil imports will increase due to declining domestic production and demand growth. However it does not consider the status of oil exporting nations nor the geopolitical feedback loops that are likely to impact upon liquid fuels security.

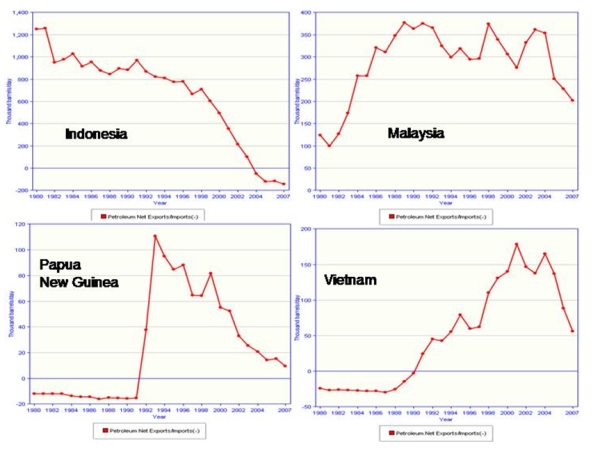

As an example, the oil exports from four of the top five countries that Australia imports oil from are in decline, as shown in the following charts, sourced from the US Department of Energy’s Energy Information Administration (EIA).

Oil exports are likely to continue to decline as these nations are post peak oil production and their domestic consumption is increasing. The oil wealth generated through oil exports encourages increased domestic consumption while reducing oil available for export. This situation is replicated among many of the world’s oil exporting nations.

Based on EIA data, it appears that exports from the world’s top 15 oil exporters, who provide more than 90 per cent of world oil export’s may have peaked in 2005. If world oil exports are in a terminal decline and demand for oil imports increases, clearly there is going to be an issue with sourcing imports.

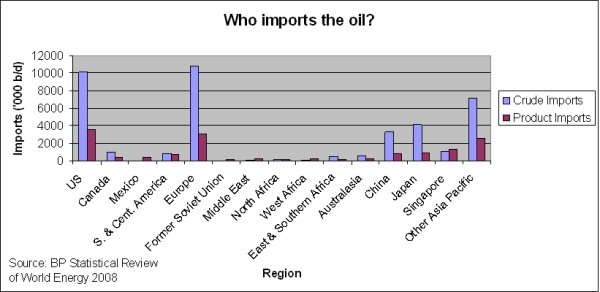

Both the LFVA and NESA avoid this significant problem by stating that the diversification of oil supply sources is important without identifying that all oil importers will be attempting to diversify supply sources. The competition for oil exports will be intense and leads to the next issue: geopolitics.

The competition: Australia is a minor player in the oil import game. The competition will be intense to “diversify” supply

The NESA states that the “longer term outlook for liquid fuel security will see increasing reliance on difficult geographic and geopolitical regions. This may result in price volatility.” While price volatility is of concern, this statement significantly understates the potential for geopolitical problems resulting from dependence on oil imports. Former US Air Force Intelligence Officer, Jeff Vail, has identified a number of geo-political feedback loops that will exacerbate the problem of declining oil exports.

A summary of the major feedback loops are:

Return on investment

Increased scarcity of energy, as well as increased prices, increase the return on investment for attacks on energy infrastructure. This already occurs in many countries including Nigeria, Iraq, Yemen and Mexico. For example, a 2007 attack on natural gas pipelines in Mexico was estimated to have a return on investment of 1.4 million per cent.

Mercantilism

Declining oil exports will encourage nations to guarantee sources of supply through long term supply deals. China is particularly aggressive in this regards, signing recent deals with Brazil and Russia to secure long term oil supplies and investing in energy companies around the world. Energy mercantilism will further reduce the amount of oil available for importation and encourage other countries to lock up long term supplies. Another option is military adventurism.

Nationalism

Nigeria is a forced amalgamation of numerous distinct ethnic groups. Nigeria’s oilfields however are only found in a small number of provinces. This poses a difficult problem. Nigeria as a nation state has an ownership claim on the oil reserves within its borders, but so do the traditional land owners. Add corruption and inequal distribution of oil wealth and the situation is ripe for internal conflict. The Movement for the Emancipation of the Niger Delta (MEND) has significantly reduced Nigerian oil exports as they attack oil infrastructure to further their political objectives. As oil exports decline and thus the wealth from oil exports decline, this problem will become more prevalent.

These feedback loops will reinforce each other and impact globally. For example Mexico will soon turn from major oil exporter to net importer. This will increase the scarcity of oil exports around the world exacerbating both the likelihood and impact of the other feedback loops. It is difficult to forecast exactly how geopolitical feedback loops will impact upon Australia’s liquid fuel security but it is reasonable to expect that declining oil exports combined with geopolitical feedback loops will have a negative impact on Australia’s oil supply. There is another feedback loop however that deserves a section on its own, and that is oil industry investment.

Investment

The International Energy Agencies (IEA) World Energy Outlook 2008 stated that there is a “real risk that under-investment will cause an oil-supply crunch” before 2015. This was prior to the full impact of the global financial crisis. A recent report (PDF 424KB) from the IEA suggests that global energy sector investment will fall by 21 per cent in 2009 with projects the equivalent of 6.2 million barrels a day, around 8 per cent of current world oil production, being cancelled or delayed. The Economist warns that investment shortfalls will result in another oil price spike when global demand for oil recovers.

Whilst not the sole cause of the global financial crisis there are a number of economists, such as Jeff Rubin and Dr James Hamilton (PDF 638KB)who argue that the oil price increases of 2005 - 2008 were a major factor in the current financial crisis. For example, Rubin states that:

The oil price rises, and the economy stalls. The demand for oil then drops sharply, and the oil price falls. Consumers and producers alike heave a sigh of relief and get back to work until the next spike.

Rubin’s research also suggests that there is a link (PDF 748KB) between oil price spikes and global economic recessions with five of the last six global recessions being preceded by an oil price spike.

The investment feedback loop suggests that a lower oil price, resulting (at least in part) from economic recession triggered by high oil prices will lead to falling investments and increase the likelihood of future oil shocks. The NESA acknowledges that there is a risk of a supply side crunch however not until 2018 is this seen as a concern. Current events would indicate that this supply crunch is likely to occur much sooner. Treasury expects economic growth of 4.5 per cent in 2011-12. This is about the same timeframe that the next oil shock is likely to occur. If the link between oil price spikes and economic recession holds, then it is hard to see how this recovery will be possible. This in turn raises the question of how the Government will pay off its debt.

A more realistic liquid fuels security assessment

The real weaknesses of the both the NESA and the LFVA are not the analysis themselves but the questions that are not asked and hence not answered. Considering these key questions, namely declining oil exports, geo-political feedback loops and the investment outlook provides the opportunity to make a more realistic appraisal of Australia’s liquid fuel security as detailed below:

| |

Current |

2013 |

2018 |

2023 |

| Adequacy |

High |

Moderate |

Low |

Low |

| Reliability |

High |

Moderate |

Moderate |

Low |

| Affordability |

Moderate |

Low |

Low |

Low |

| Overall |

High |

Moderate |

Low |

Low |

A realistic appraisal of Australia’s liquid fuel security

- Adequacy: the adequacy of Australia’s future oil supply is based upon this model which suggests that Australia’s fuel supply could fall short of projected demand by over two thirds by 2025.

- Reliability: the increasing impact of geopolitical feedback loops over time and the requirement to increase the length of our oil supply chain will reduce reliability of supply.

- Affordability: oil prices are likely to remain volatile over the longer term however the overall trend will be up.

Why is this important?

Australia and the world appear to have three big and conflicting investment requirements. It is highly improbable that there is sufficient investment available to meet the demands of all three. The requirements are:

- maintaining the production capacity of our fossil fuel energy sources;

- developing a renewable energy economy to replace fossil fuels as reserves deplete and to minimise the impacts of climate change; and

- responding to the global financial crisis.

Currently, it appears that governments around the world are focusing on the third and least important requirement through financial stimulus packages. This short sighted approach is aimed at maintaining “business as usual” (BAU) and is a consequence of governments failing to address the issue of oil depletion. The long term consequence is that there will be insufficient investment in both fossil fuel and renewable energy and is in fact the worst case scenario. It will result in further economic hardship from future oil shocks and increase the likelihood of dangerous climate change while not providing an alternative energy system. In effect, by trying to maintain BAU our government is actually reducing the likelihood that something like BAU can be maintained.

Of course, it does not have to be this way. A realistic appraisal of Australia’s liquid fuel security would encourage policies focused on significant growth in renewable energy, energy efficiency, rail and mass public transportation. Such an approach seems to offer the best chance of reducing oil dependency, reducing the impact of oil shocks, addressing climate change, maintaining a level of economic prosperity and creating employment. However this requires a significant change in direction by Government. According to the IEA (PDF 423KB) only 5 per cent of global stimulus packages to date have been focused on energy efficiency and clean energy. The IEA warns that the level of new funds allocated to energy efficiency and clean energy should be four times current levels and be sustained each and every year for the next few decades.

Conclusion

On the face of it, both the NESA and LFVA appear to be a comprehensive analysis of Australia’s liquid fuel security situation. However, both reports ignore or avoid the critical issues that will impact upon Australia’s future liquid fuel supply. This results in an inappropriate assessment of Australia’s liquid fuel security. The unfortunate consequence is that Australia is likely to face significant economic and social hardship over the next few decades as our liquid fuel security declines. The really disappointing aspect is that much of this hardship could be avoided through a realistic liquid fuel security assessment and appropriate policy responses. This poses the interesting question of why have these issues been avoided?