Last Friday saw Australia's equity markets close up 30 per cent (including dividends) for the year.

This marks the fourth year of annual returns above 20 per cent. Surely it doesn't get any better than this? But could it get much worse? Henry's column last month was about the global asset boom (which Henry sees as a bubble). "The problem's global, we're feeling nervous" is a fair summary. The period since has included a plethora of warnings by financial market practitioners.

Last month, the Bank for International Settlements (BIS) also weighed into this debate. Its annual report noted the current "extraordinary" performance of the world economy - high growth, low unemployment, moderate inflation and low-volatility growth of asset prices.

Advertisement

The sting in the tale was a stern warning about sustainability: "However, the combination of developments is so extraordinary that it must raise questions about the source and, closely related, the sustainability of all this good fortune."

It is impossible to believe the central banker's central bank is not thinking hard about asset inflation in the light of this comment.

What is agreed is that the current asset boom/bubble has been fuelled by the flood of global liquidity, whose onset was sparked by US cash rates at 1 per cent in 2003, though neither the BIS nor national central bankers would state it so baldly as that.

What is less clear is what to do to prevent asset boom/bubbles. Adding asset prices to the conventional goods and services inflation in central bank policy targets is the obvious point, although there would be a host of practical issues to be resolved before this become part of the accepted wisdom.

Of course, allowance for asset inflation would logically require central banks to allow systematically for asset deflation, and expected (or even "possible") asset deflation. In fact, central banks have been famously willing to provide generous "accommodation" when there is incipient financial panic. It was the US Fed's unwillingness to do just that in 1929 that some historians see as a major reason for the depth and severity of the Great Depression.

So, as we argued last month, there is a case to allow for asset inflation as well as goods and services inflation in determining monetary policy. With globalised economies and markets, international co-operation by central banks is vital, which is why the views of international organisations such as the BIS are so important.

Advertisement

As a practical matter, goods and services inflation has been held down for the past decade by the rise of the "BRICs" - Brazil, Russia, India and the daddy of them all, China. Cheap labour and generally free trade in manufacturing has exercised a powerful deflationary influence in the developed nations, helping to keep wage inflation low despite the easy money that has, therefore, fuelled asset inflation.

Now there are clear signs of rising wage pressure and rising inflation in the BRICs. Conventional wage push inflation is inevitable in these nations as their flood of cheap labour begins to gain market power and to demand a larger share of the economic action.

As this pressure builds, the easy years for central bankers will pass. The signs are becoming clear. The clearest evidence is that goods and services inflation bottomed at the start of the new century, and has been creeping up since then.

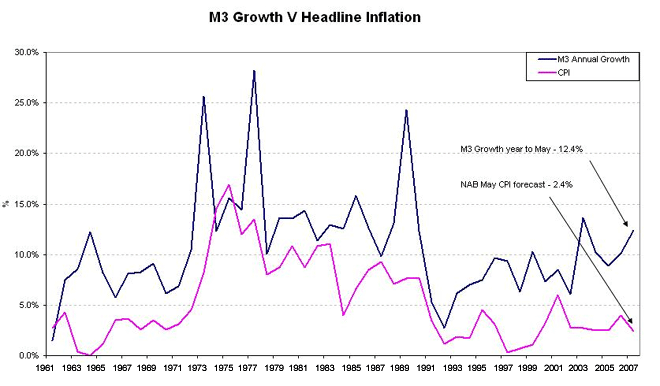

The graph illustrates this point for Australia (where the low point was in 1997-98) but, like asset inflation, this is also a global phenomenon.

The graph shows the generally positive correlation between inflation and monetary growth. The correlation has been complicated by financial deregulation and involves fierce debate about causation - is money the horse or the cart?

This point is irrelevant to the conclusion that the rise in monetary growth - also a global trend - is a second sign of rising inflationary pressure. A third indicator is the rise of bond yields. The rise since 2003 has been in fits and starts but during June there was a decisive breakout in which yields on 10-year bonds in the US hit 5.3 per cent. There has been some retracement since, but like the rise of inflation itself, and the rise in monetary growth, the global trend in bond yields is now clearly established.

Sharp increases in commodity prices have also been part of the global inflationary trend, as a direct and much-commented-on influence of the BRICs-boom. Oil is one commodity whose influence cannot be ignored because of its influence on the price of petrol in the Western nations. Ominously, the price of oil is again trending up.

It's been the practice of central banks to downplay the price of petrol and other "one-off" sources of inflation as not part of so-called "underlying" inflation. But there is another emerging debate, reported last month by The Economist magazine, on the perils of this approach.

The Economist commented: "After a jittery few weeks, bond markets rallied on June 15th on news that the US's core consumer price index rose by just 0.1 per cent in May. The data was warmly greeted by stock markets too. The Dow Jones index rose by 86 points on the day. Investors decided that the absence of price pressures would calm the nerves of rate-setters at the Federal Reserve, who have been worrying out loud about "elevated" core inflation.

"What the markets blithely ignored was the day's bad news. Headline consumer prices rose by 0.7 per cent, the biggest monthly increase for nearly two years. Unlike core inflation, the headline measure includes fuel costs, which rose sharply, as well as food prices. For bond prices to rise on such a big jump in inflation, markets must be placing a great deal of faith in the core index as the true gauge of price pressures. Is that wise?"

Hear, hear, says Henry. Asset inflation is a wonderful thing for owners of assets, like Henry and readers of this newspaper. Sharply rising asset prices should nevertheless have produced tighter monetary policy sooner. This point is still controversial.

What is not controversial is that goods and services inflation, the currently conventional indicator of the need for policy action, is clearly on the rise. The RBA cannot act on its own, but the BIS report shows that the global central bankers are on the case. Action now would be politically awkward in Australia. Putting politics aside, as Glenn Stevens is duty-bound to do, better a 25-basis point hike now than bigger hikes in early 2008.

Over to you, Mr Governor.

First published in The Australian on July 3, 2007 and on Henry Thornton’s website.