House prices remain strong in the resource states, and even in Melbourne there are signs of slight recovery. Only Sydney is teetering on the edge of recession, and the Reserve Bank would not dare to cut rates to help get the beggars off the streets around Martin Place at the risk of allowing the non-NSW economy to overheat.

Inflation has surprised slightly on the upside, and it is Henry's view that the brotherhood of central bankers sometime in the recent past decided oil at roughly current levels was a threat to global inflation and ultimately to the continuation of global prosperity. There should be less pressure on the Reserve Bank than on other central banks whose interest rates became so low in the early years of this century, but more rate hikes here cannot be ruled out.

Looking further ahead to 2007, the Howard Government, or even a refurbished coalition government led by Peter Costello, should be able to deliver another generous budget and maintain its general reputation for managerial competence.

Advertisement

Whoever gets to succeed Ian Macfarlane at the RBA will be another safe pair of hands who will act cautiously to maintain the reputation of Australia Inc.

Clearly, there are real challenges, including boosting the skills of the Australian workforce and raising participation of some groups, especially indigenous Australians. But running a firm but not tight monetary policy will be the job of the Reserve Bank.

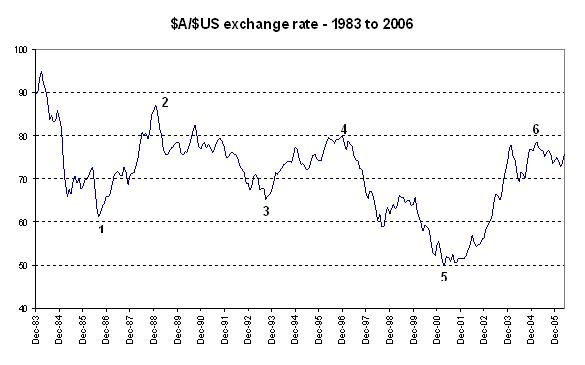

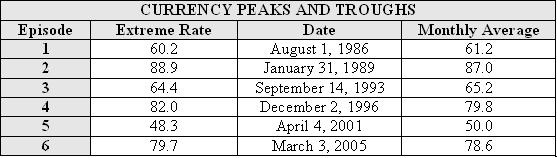

A strong currency is a sign of a strong economy. The fact that the Australian dollar has held its ground in recent years is a good sign. The fact that there is as yet no sign of an upward trend in the value of the Australian currency is a disappointing sign.

The 2006 budget created the first tentative steps in income tax reform, including superannuation reform. If there are further steps in coming years, the Aussie dollar might eventually achieve a return to approximate parity with the mighty US dollar.

That would be an event to celebrate.

Advertisement

Discuss in our Forums

See what other readers are saying about this article!

Click here to read & post comments.

10 posts so far.