Henry got into considerable trouble when he told a prime minister that "his" country's currency was like a company's stock price - the best overall indicator of how the nation was perceived in the marketplace.

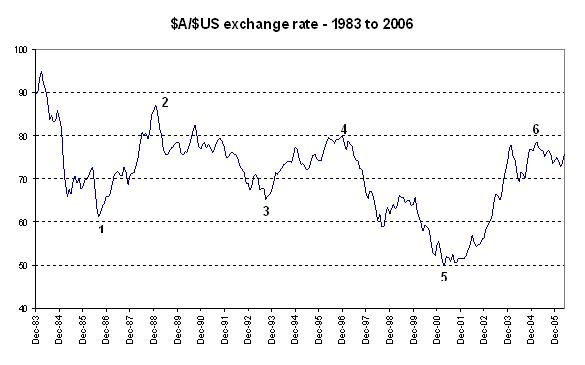

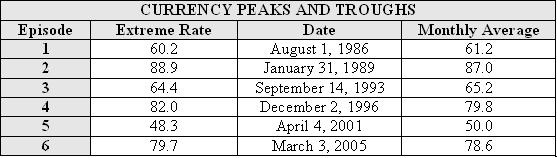

The graph shows the value of the Aussie dollar (as a fraction of the mighty US dollar, expressed as monthly averages) since the float of the Aussie in 1983. Broadly speaking, the floating Aussie has declined in fits and starts, following what is, in fact, a century-long trend. The rate of decline may, in fact, have become slower, but (for example) the low value of 50c in early 2001 was well below the low of 61c in 1986, and peak values are also still declining.

The floating Aussie dollar started life at approximately 90 per cent of a US dollar. After briefly rising toward parity, the Aussie quickly sank, with brief updrafts, to become a 60c dollar. This was at Banana Republic time, and Treasurer Paul Keating reportedly sat in cabinet reading out the pace of the fall from a hand-held device as he urged still greater austerities on his nervous colleagues.

Advertisement

Cabinet approved swingeing spending cuts, the ACTU copped a cut in real wages and the Reserve Bank tapped the monetary brakes. US interest rates were falling then and the gap in favour of Australian interest rates widened considerably.

Like the economy, the battling Aussie dollar then staged a solid recovery, back almost to the benchmark 90c level.

Using the corporate analogy, "Well done, Prime Minister, well done, Treasurer" was the obvious point to make. Or even: "Congratulations on an even bigger comeback than BHP."

Success in economic policy as in life generally requires constant focus. Keating took his eye off the economy as he struggled, successfully in the end, to oust his boss. The Aussie dollar fell to a low of US64 cents as interest rates fell in the wake of "the recession we had to have".

A new peak of 80c occurred shortly after the Howard Government was installed to implement its new anti-inflationary pact with the Reserve Bank, providing added confidence in the future of Australia Inc.

The famous GST election in 1998 could well have installed a new Beazley government and it is no coincidence that the Aussie dollar sagged in the lead-up to that election and then staged a fitful recovery. New depths were plumbed in early 2001, with the Aussie dollar reaching a low of US48.3c on April 3.

Advertisement

With serious concern about a US recession not generally shared in Australia, US interest rates fell sharply, far more so than Australian rates, and the Aussie dollar rose again almost to 80c.

Currently the Aussie dollar - Australia Inc's share price - is hovering in the middle 70s, trying to decide if it will rise or fall from here. Factors holding it up include confidence in the managerial ability of the Howard Government and the wonderful bonus of high and perhaps still rising terms of trade. (Rapidly rising commodity prices have boosted BHP Billiton's share price even more than that of Australia as a whole).

US interest rates have been rising, albeit from extraordinarily low levels, and this has produced some countervailing downward pressure. Strong terms of trade seem likely to persist while ever the global boom continues. While there are some warning signs in the mighty US economy, China, India and Japan all seem to be keeping the global boom running strongly. Local interest rates will be kept high by booming business investment, the effects of tax cuts and generous handouts and perhaps also by strong retail sales.

House prices remain strong in the resource states, and even in Melbourne there are signs of slight recovery. Only Sydney is teetering on the edge of recession, and the Reserve Bank would not dare to cut rates to help get the beggars off the streets around Martin Place at the risk of allowing the non-NSW economy to overheat.

Inflation has surprised slightly on the upside, and it is Henry's view that the brotherhood of central bankers sometime in the recent past decided oil at roughly current levels was a threat to global inflation and ultimately to the continuation of global prosperity. There should be less pressure on the Reserve Bank than on other central banks whose interest rates became so low in the early years of this century, but more rate hikes here cannot be ruled out.

Looking further ahead to 2007, the Howard Government, or even a refurbished coalition government led by Peter Costello, should be able to deliver another generous budget and maintain its general reputation for managerial competence.

Whoever gets to succeed Ian Macfarlane at the RBA will be another safe pair of hands who will act cautiously to maintain the reputation of Australia Inc.

Clearly, there are real challenges, including boosting the skills of the Australian workforce and raising participation of some groups, especially indigenous Australians. But running a firm but not tight monetary policy will be the job of the Reserve Bank.

A strong currency is a sign of a strong economy. The fact that the Australian dollar has held its ground in recent years is a good sign. The fact that there is as yet no sign of an upward trend in the value of the Australian currency is a disappointing sign.

The 2006 budget created the first tentative steps in income tax reform, including superannuation reform. If there are further steps in coming years, the Aussie dollar might eventually achieve a return to approximate parity with the mighty US dollar.

That would be an event to celebrate.