In truth, the Henry Review Committee, which is to report to government by the end of the year on reform of Australia’s system of taxes and social security payments, faces an enormous list of potential reform options for adoption over the next year or two or over some decades.

One way to categorise the reform options is to evaluate the different tax bases or taxable sums, the tax and payment rate schedules attached to each base, the mix of tax bases, and then some of the options for changes. Under broad political constraints of an aggregate revenue neutral package of changes that maintains approximate vertical equity in redistribution, this article considers reform options that could reduce distortions of the income transfer system to decisions on work, investment and so forth, that would simplify the system and reduce costs of compliance, and changes to improve horizontal equity.

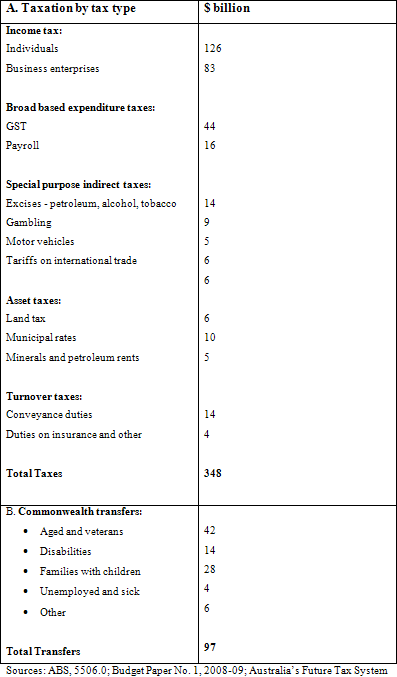

Table 1 provides a broad overview of Australia’s income transfer system in terms of broad tax base categories levied by the commonwealth, state and local governments, and of social security payments paid by the commonwealth government.

Advertisement

In 2007-08 total tax revenue of $348 billion represented 30.8 per cent of national income. They provide revenues, or access to labour, capital and other resources, to provide public goods such as law and order and defence, to fund public provided education, health and housing, and for redistribution to achieve society goals of equity. Direct income payments to the aged, those with disabilities, families, the unemployed and others are the most important source of income for about a third of Australian households. In 2007-08, $97 billion was redistributed.

Table 1: Main Taxes and Social Security Payments, Australia 2007-08

Income tax accounts for about 60 per cent of aggregate tax revenue. It is collected directly on individuals and as a withholding tax on business enterprises (including corporations and superannuation funds).

The ideal income tax base, or taxable sum, includes all forms of labour remuneration, and the returns on all investments in financial deposits, shares and property. In practice the current income tax system has many special exemptions and deductions, often referred to as tax expenditures, which reduce the tax base below its potential.

Treasury in its Tax Expenditure Statement 2008 reports tax expenditures of about $55 billion in foregone income tax revenue. Examples include concessional tax rates for remuneration taken as fringe benefits and lump sums, tax rebates for those in remote regions, a halving of the tax rate for capital gains, and concessions for savings invested in superannuation and in owner occupied homes, and concessions for some business investments.

Advertisement

A very significant income tax reform would remove the special exemptions and deductions for particular categories of income and treat a dollar of income as a dollar regardless of the form of labour remuneration or of the form and place of investment. A comprehensive income tax base would reduce distortions to decisions and increase national productivity, it would provide for greater horizontal equity, and it would contribute to a simpler tax system with few incentives for wasteful tax avoidance schemes. Also, and as a key part of a reform package, the sticks of a broader base would fund the carrots of lower tax rates while collecting the same revenue.

Several reforms to the progressive income tax rate schedule could be considered. Automatic indexing of the tax brackets each year for inflation would eliminate the income tax share of the economy rising with inflation, and force greater honesty on government “tax cuts”. The current rate schedule would be more transparent and simplified by incorporating the low income tax offset and senior Australians tax offset in the schedule rather than as ad hoc add-ons. Similarly, removing the complex Medicare levy with its contribution to a zone of high effective marginal tax rates would simplify income taxation.

Australia has two potential broad based taxes with a similar economic incidence on consumption expenditure. The goods and services tax (GST) falls on income spent and exempts income saved, and the payroll tax falls on labour income and exempts capital income which is the return on saving. More comprehensive and broader tax bases, for example following the New Zealand example for the GST and removing the small firm exemptions for payroll tax, with the revenue gain used to fund lower rates or to reduce other more distorting taxes, would improve national productivity and simplify the taxes.

Discuss in our Forums

See what other readers are saying about this article!

Click here to read & post comments.

2 posts so far.