Saudi Arabia’s oil production company is Saudi Aramco. Its former Vice President of oil exploration and production, Sadad al Husseini, recently made the following comment on oil prices at the 30th Oil & Money Conference, held in London on October 20-21:

… as you go up to say $90 a barrel, you’re consuming 4.5% of the global economy [for oil]. That in itself is a ceiling - you cannot go indefinitely into more expensive alternatives without destroying [the] economy and therefore destroying demand. So we do have a ceiling on prices and how much expensive alternative fuel we can put into the market.

This is an idea worth exploring further. Before the recent peak in oil prices in July last year most peak oil commentators believed that the sky was the limit for oil prices. Indeed, economic modeling in a CSIRO report released only one month before the $147/barrel oil price peak of July 2008 “Fuel for Thought, The Future of Transport Fuels: Challenges and Opportunities” (PDF 1.47MB) predicted a petrol price of up to AUD$8 a litre by 2018 if the peak of oil production were to occur soon. This would correspond to a crude oil price of somewhere around US$500 per barrel.

Advertisement

We are now more than a year past the July 2008 oil price (and production) peak and in that time we have seen the price of oil drop as low as US$30 per barrel to then recover to about $80 per barrel. While the global financial crisis was brought on by a property debt bubble that was destined to burst at some stage, an analysis by economist James Hamilton (PDF 637KB) indicated that it was the record high oil prices of mid-2008 that pricked that bubble. Indeed, as described by commentator David Murphy, most US recessions since the 1970s have followed periods of rapidly rising oil prices: the US economy cannot tolerate an expenditure on oil which constitutes more than 5-6 per cent of GDP.

Mainstream thought in peak oil circles is now that the $147/barrel oil price of July 2008 may represent the “peak oil price”. In other words, we may never see an oil price that high again since, at that level, the high cost of energy cripples economic activity, plunges economies into recession and thus kills demand. This is what Sadad al Husseini is talking about. (Amusingly, this phenomenon has provided a face-saving escape route for the most ardent critics of the peak oil thesis - namely BP’s chief executive Tony Hayward and oil industry cheer-leader Cambridge Energy Research Associates - who now declare that the developed world has passed “peak oil demand”. However, that is nothing but a delusion to disguise the fact that dwindling oil supplies have ended economic growth in the developed world for the foreseeable future.)

Earlier this year I wrote an essay in On Line Opinion titled, “Energy is Everything” in which I described how our entire economy can be seen as being comprised of the energy used to power activities and the embodied energy used in the production of things. Money is simply a tool that can be used to exchange and allocate these different forms of energy.

Since 60 per cent of the energy in our world economy comes from burning the hydrocarbons oil and gas, a decline in their availability will reduce world economic activity. In fact, we face twin, compounding challenges. Not only are hydrocarbons in decline, but the energy required to extract and process these hydrocarbons is steadily increasing. This is reducing the “net energy” from hydrocarbon production - less and less of the energy produced by hydrocarbon extraction is available to do other things (such as power the economy) and more and more of the energy production is being recycled back into the process of producing the energy itself.

This concept that energy production itself requires the investment of energy is known as “Energy Return on Investment” or EROI. A fascinating figure (from Euan Mearns) that I previously copied shows that when the ratio of energy produced over energy invested drops below 5:1, the amount of energy we can use to maintain our society drops off rapidly (we fall over the “Net Energy Cliff”):

Sadad al Husseini’s comment is interesting since it allows us to make a very crude calculation of where the world might stand in terms of EROI for oil just now. Recently, a number of commentators including al Husseini have described how the barrel price of oil must remain above $70 to cover the cost of new oilfield development. Now if $90/barrel oil is 4.5 per cent of the world economy then $70/barrel is about 3.5 per cent of the world economy. You might think that this represents an EROI of about 100/4.5 or 29:1. But al Husseini’s comments are about, specifically, the crude oil price that does not include energy contributed by gas, coal or nuclear sources and so on (although oil use greatly facilitates the use of these other energy sources). Crude oil contributes 37 per cent of the world’s energy so, if the economy is energy and 3.5 per cent of that energy must be reinvested into oil production we are looking at an EROI of about 11:1. This is similar to the EROI range of 11-18:1 for oil production in the year 2000 that I cited in my previous article. Thus it seems that we are rushing towards the “net energy cliff” where the energy profitability of oil extraction will fall dramatically and the rest of the economy (that existing outside of the oil extraction, processing and distribution sector) will be starved of energy and hence contract mercilessly.

Advertisement

We can also look at this another way. What must actually be done to extract oil? Of course, we can easily see that we need to spend energy surveying the oilfield and drilling down into it. Then we need energy to pump up and process the oil and transport the various products to their end-users. But there are huge other, less visible energy bills to be paid. The oilfield infrastructure/technology must be constructed/manufactured and the oilfield workers and their families must be housed, fed and clothed. The engineers must be trained at universities that require energy to run and the factories that make the oilfield infrastructure must be built and powered. The workers in those factories must also be housed, fed and clothed and their cars and holiday flights must be provided with fuel.

What I am trying to point out is that it is impossible to draw a line around all the energy in the economy that is used just for oil production. Oil production exists as part of an intricately interlinked system - literally part of a human energy ecology. Oil production can only occur at its current rate/scale because the other elements of our economy are functioning sufficiently.

As we slide over the net energy cliff and more and more of the energy produced from oil extraction must be recycled back into the process itself, the rest of the economy will be starved of energy, especially in the areas of transport (95 per cent dependent upon oil) and food production (requiring ~7 calories of fossil energy to produce one calorie of food energy). There will be less energy to power the global logistics chains that supply the factories around the world with the maelstrom of materials produced by other factories that are themselves dependent upon other factories (and so on) in a complex interdependent web.

The plastics used by the majority of these factories will also be more expensive. This will impact on the ability of the high-tech oil industry to maintain production. There will be less energy to keep the universities running to train the engineers to keep oil production up. At lower levels of total energy we simply will not be able to maintain the current complex economy and society that allows oil production at its current scale to occur. This is why it is extremely doubtful that there will be a gentle decline in oil production after peak oil.

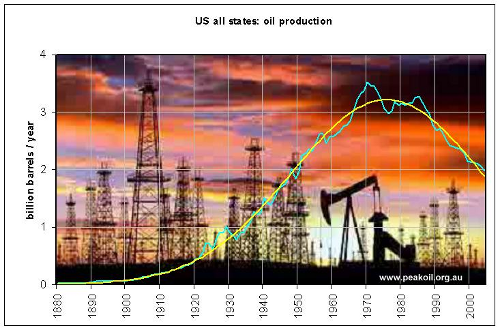

Peak oil commentators commonly cite the peak of oil production in the USA as an example for what the world faces as a whole in terms of oil production. The US peak appears quite symmetrical - the rate of production increase on the way up to the peak is broadly similar to the rate of production decrease after the 1970 peak of production.

However, the only reason why this could occur, in the face of decreasing EROI was because the USA was able to subsidise oil production post-peak using other forms of energy. The thousands upon thousands of pumpjacks (“nodding donkey” oil pumps) that now extract the dregs of the USA’s oil inheritance are primarily powered by electricity from coal-fired and nuclear power plants. Despite its declining oil production, the USA’s population and economic activity have been able to expand since 1970 by using a larger amount of oil energy now provided by imported oil.

Today, the USA imports about two thirds of the oil energy it consumes. But after the world peak of oil production there will be no other place to import oil from. The process of oil extraction can be subsidised by coal, gas or nuclear-derived energy where access to these exists. However, the history of oil production has been a continuous journey to ever more remote and inaccessible areas to find oil. Unlike the USA, most of these areas do not have electricity “on tap”. Dmitry Orlov wrote very amusingly about the decline of oil production after the world peak in his essay, “The Slope of Dysfunction”.

To cover the costs of developing new sources of oil, the barrel price of oil must remain above US$70. However, as supply falls and economies continue to attempt to grow, oil will re-enter the economy-killing zone above $100 (where 5 per cent of world GDP is going to oil purchases. This will, once again, destroy economic activity leading to another reduction in oil demand and another collapse in the oil price to below the necessary US$70 per barrel. These gyrations in the oil price will discourage investment in new projects and contribute to a much faster drop in oil production. The happy news for motorists is that oil is unlikely ever again to reach $147/barrel (inflation adjusted). The unhappy news is that the motorists will probably be unemployed and unable to afford the oil in any case.

If our society and civilisation is to survive the challenge of declining oil (and, ultimately, declining natural gas, coal and uranium) we need to invest in renewable forms of energy and adapt to the more or less variable supply that the various renewable sources provide. (Improved battery technologies would be a huge assistance in this regard.)

However, renewables form only a tiny fraction of the world economy at present and expanding them to fill the fossil gap - while the economy is in decline, food production is disrupted and many other calls are being made on the dwindling net energy supply, will involve extreme sacrifice that the citizens of developed nations will only make unwillingly. By the time they realise the necessity there will probably be little net energy left to build the renewables infrastructure in any case.

Late additional note:

In an article with a related theme titled "Recovery Over a Barrel" in The Courier-Mail of November 20 and that also raises issues from my previous On Line Opinion essay Paul Syret reported the following that indicates that both the Labor and Liberal parties continue to try sweep the peak oil issue under the carpet:

It went unreported in the media this week, but on Wednesday Greens deputy leader Christine Milne noted in the Senate that: "Neither the former Howard government nor the Rudd Government implemented the first recommendation of the 2007 Senate Rural and Regional Affairs and Transport Committee report into Australia's future oil supply and alternative transport fuels.

This recommendation was that Geoscience Australia, ABARE and Treasury reassess both the official estimates of future oil supply and the "early peak" arguments and report to the government on the probabilities and risks involved, comparing early mitigation scenarios with a business-as-usual approach.

She called on the government to "develop a national plan to respond to the challenge of Peak Oil and Australia's dependence on imported foreign oil". The motion was defeated 31 votes to six.

The most basic logic should tell us we can't continue to increase the exploitation of a finite resource indefinitely.