It is fascinating to watch the behaviour of our political and business leaders as they attempt to cope with the world’s deepening financial crisis. It is becoming clear that they don’t have a clue what is actually going on. Their blindness is explained by confusion about what actually enables economic growth. The shared delusion is that money makes the world go round.

As share and asset values crash we hear talk of deflation. Many nations are trying to counter this by expanding their money supply. However, they seem to have forgotten the most basic fact about money that we are taught in school - that it is a medium of exchange. Money allows agreements on relative “value” (how much of one thing will be exchanged for another) but it has no intrinsic value itself. It is simply a mechanism that allows the distribution of real “stuff”. So if the economy is crashing what is this “stuff” that is disappearing? It can be summed up in one word - energy.

Energy is everything

No living or manufactured thing exists on this planet without energy. It enables flowers and people to grow. We need energy to mine minerals, extract oil or cut wood and then to process these into finished goods. Without energy the goods would not exist so we can think of each product as containing “embodied energy”. So the most fundamental definition of money is that it is a mechanism to allow the exchange and allocation of different forms of energy. The economy is energy.

Advertisement

The most important source of energy in the world economy is hydrocarbons - molecules made up of hydrogen and carbon atoms. Small hydrocarbon molecules form gases such as natural gas. Larger molecules form the liquid we know as crude oil. Hydrocarbons can be burned to provide heat energy to power generators and motors. Almost all transport relies on liquid hydrocarbon energy. Hydrocarbons are also incredibly useful for making plastics. It is difficult to find any manufactured thing that does not now include plastic. Oil and natural gas provide almost 2/3rds of the energy used in the world economy. A simpler way to say this is that hydrocarbons are 2/3rds of the world economy.

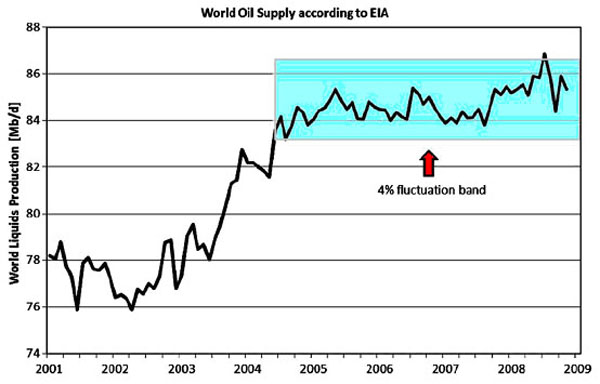

Until recently (about 2005) the world economy was growing. The number of people has been increasing which requires increased production of food, clothing and shelter - the basics. On top of this, many of us have been using more energy than previously - to travel farther, eat more food, buy additional clothes and enhance our shelters. Until 2005 we could expand our energy use to meet this demand. This is something we were able to do - with occasional interruptions - for the past 150 years. However, after 2005 we could not expand our energy supply. In other words we could not expand the world economy.

(From Höök, Hirsch and Aleklett 2009. Giant oil field decline rates and their influence on world oil production. Energy Policy, in press. Since mid-2004, production has stayed within a 4 per cent fluctuation band which indicates that new production has only been able to offset the decline in existing production.)

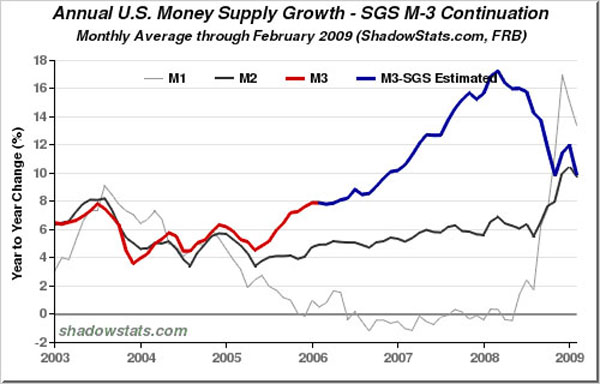

Oil supply was flat from 2005 onwards and is now in decline. That is not to say that we did not try to expand the world economy after 2005. However, much of the expansion that occurred was an illusion. In many industrialised nations a great deal of “money” was created (by increasing the money supply and other means) but it did not correspond to an increase in energy use. This is illustrated by what happened in the USA, where the rate of money creation increased greatly after 2005:

Courtesy of shadowstats.com

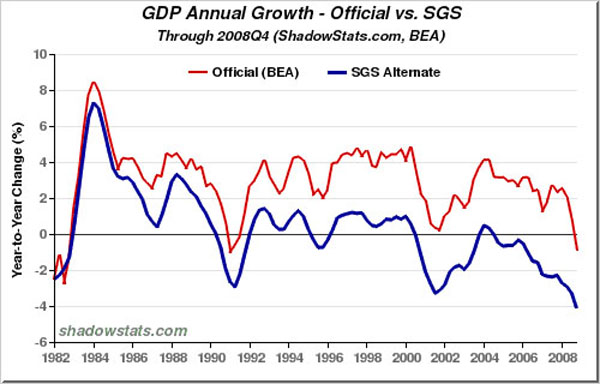

Meanwhile, the US economy began to contract at an accelerating rate. If you ignore the way the US government fudges its GDP calculation method to maintain a rosier picture, you can see that that the US economy has been contracting since 2005:

Advertisement

Courtesy of shadowstats.com

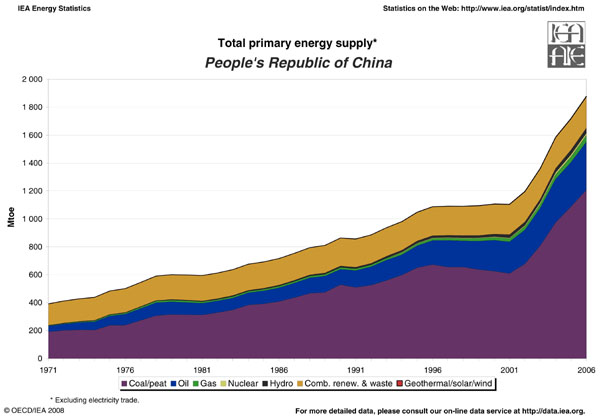

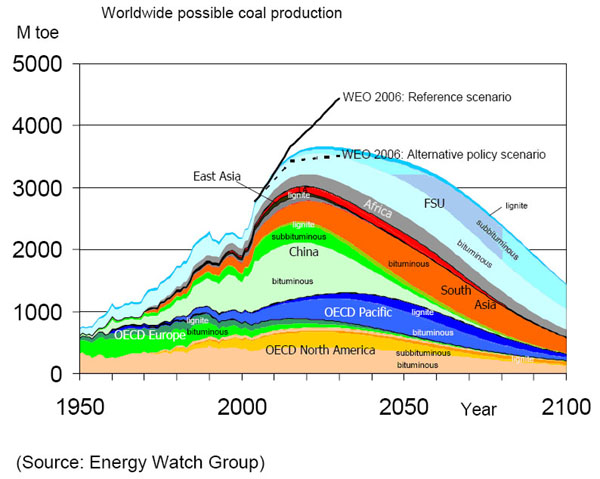

China managed to grow until recently by laying claim to a greater proportion of the world’s stagnant production of oil . This was a significant factor in increasing the demand for, and price of, oil. China has also been rapidly expanding its coal-fired electricity generation. Indeed, coal provides the bulk of China’s energy (see the purple area in the figure below):

As a whole, the world may attempt to turn to coal to continue to grow its energy production. However, the USA (the world’s greatest coal province) is already past peak net energy from coal production even though its total mined tonnage increases. World coal production is expected to peak before 2030 and will only be marginally higher than current levels. Coal currently supplies only 25 per cent of world energy so this will not compensate for the decline in energy from oil:

Where are we going?

Every time a politician talks about market “sentiment” or says that the market needs “confidence” to recover what they are really confessing is that the pseudo-science of economics provides no reliable predictions for market behaviour. If economics was actually a science it would have undergone a progression of theory development where only those theories that provide reliable predictions of behaviour would be retained and unsuccessful ideas would have been rejected. Obviously this has not happened. (As an article in the journal Scientific American described it, "The Economist Has No Clothes".)

On the other hand, chemistry and physics can provide very reliable predictions for the behaviour of systems. The laws of thermodynamics tell us how energy determines what a system can and cannot do.

One of the greatest contrasts between economics and science is shown by their view of future energy production. Many “energy economists” believe that declining energy availability will cause the price of energy to rise and this will attract investment to stimulate development of new and alternative sources of energy. Thus the “intelligence” of the market means that an energy crisis solves itself and there is no ultimate limit to how much energy humanity can use. However, if we view the economy as a thermodynamic system (since “the economy is energy”) we would say that a high energy price leads to the greater allocation of a society’s current energy production into the production of more energy. But there is a problem - the energy investment required for new energy production from mined sources increases with time. (See my essay, “Earth as a magic pudding” in On Line Opinion, for a more detailed explanation.)

No source of energy will be exploited if the energy it yields is less than the energy investment required to exploit it. When a finite source of energy is found that does yield an energy profit, (e.g. fossil fuels) the most easily extracted part of that resource (requiring least energy investment) is extracted first since it provides the greatest energy profit. As this finite resource is used up it becomes less and less energetically profitable since more and more energy must be invested to return progressively less energy. Eventually no more energy can be extracted from the resource.

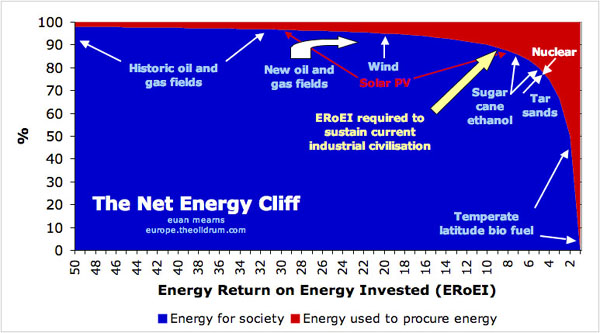

The world’s energy production is now declining and the profitability of energy production is declining at the same time. This means that the net energy available to support activities other than energy procurement will decrease much faster than the fall in total energy production. We are approaching a “net energy cliff” that gets very serious when less than five units of energy are produced for each unit of energy invested:

(From Euan Mearns at europe.theoildrum.com. “ERoEI” is Energy Returned on Energy Invested. The ERoEI of oil production has fallen from ~ 30:1 in 1970 to from 11 to 18: 1 in 2000.)

We could possibly increase energy production (“grow the economy”) if we first made extremely large energy investments in the infrastructure required for nuclear and renewable forms of energy - a “wartime crash program”-like commitment. In other words, to stop the energy decline (economic decline) we need to divert a large proportion of our remaining oil energy into building nuclear power stations and solar arrays etc. This is very unlikely to happen in democratic nations since it would require large, voluntary reductions in living standards in the midst of a serious and worsening economic crisis. The immediate cries for help now (e.g. unemployment benefits, company bailouts) will outweigh any future possibility of improved living standards. Wartime crash programs can work because a nation’s population literally has a gun pointed to its head - the population fears death at the hand of the enemy. Energy decline can be just as deadly as any human enemy but, like climate change, its effects are slower and most people do not understand enough about energy to fear its loss.

There are a number of consequences that follow from this train of logic. They are quite different to what economists are saying:

1) The world economy will contract for at least the next 50 years as oil production declines since oil is such an important proportion of world energy use and oil energy facilitates the production of other energy forms (e.g. coal mining). There may be some local and temporary economic growth in regions with local concentrations of available energy but, on the whole, contraction will be the rule.

2) Governments may attempt by stealth to divert energy investment into renewable and nuclear energy infrastructure and away from the rest of the economy. They can do this by printing additional money and then using this money for the energy infrastructure investments. However, by doing so they have not changed the amount of energy in the economy. All they have done is to dilute the energy value of each unit of currency. The nominal $ value of wealth in the rest of the economy (the non-energy infrastructure part) has not changed but the actual wealth in terms of energy in the rest of the economy has decreased since energy had been diverted out of that area.

3) Once energy is in decline the recent pervasive economic lie that everyone can become wealthier can no longer be sustained. Now one person’s increased wealth can only come at the expense of another person’s worsened poverty. Actually, it is worse than a zero sum game since the economy is not just failing to grow - it is actually contracting at the same time as the number of consumers (population) is expanding. We have come to a fork in the road where we can either share a contracting pool of wealth (energy) equally or it can become concentrated in the hands of a few to the detriment of the many. Some financial commentators believe that the bailouts of financial institutions in the USA together with the inflationary printing of money are an example of ongoing transfer of wealth to the elite. From our starting point as a highly divided society, the most likely path that we will follow is not the egalitarian one.

4) Since governments and business will be not make the required investments in energy infrastructure it will be left to individuals and local communities to cope with energy decline. As individuals we can drastically reduce our need for energy (our money expenditure) by growing our own food, living closer to our place of work and so on. Growing our own food is, of course, a method for capturing solar energy, i.e. it is a method for earning energy income. This energy in food can then be exchanged for forms of embodied energy such as items manufactured by others. For human beings, food is the ultimate currency.

John Michael Greer recently wrote an excellent article on coping with the decline of the world economy that is now underway. Read it and follow its good advice (and if you make future decisions based on the advice of economists then you have only yourself to blame).