2018 was a terrible year for commodities, but few sectors fared as badly as lithium.

The crucial battery metal, also known as "White petroleum", struggled through a 50 percent price correction as supply soared and demand fears spread like wildfire.

But it isn't time to give up on lithium stocks just yet.

Advertisement

The rising stars of the hard-rock lithium space are transforming the industry with their remarkable ability to extract lithium at a lower cost and faster pace than the lithium majors can from their brine deposits. In short, there's a new caliber of producer in town and - with lithium demand set to soar once again – their timing could not be better.

The three stand out companies in the hard-rock mining space at the moment are Albemarle (NYSE:ALB), Chinese Tianqi Lithium (SZSE:002466) and Power Metals (TSXV: PWM; OTC:PWRMF). And each of these companies are able to bring lithium to market faster and cleaner than their brine-based competitors.

Before examining the hard rock lithium space though, we need to take a closer look at the market itself. Overall, the supply-demand balance is actually much tighter than prices suggest. After all, the soaring demand from tech and energy sectors that triggered lithium's meteoric rise in 2018 didn't vanish overnight.

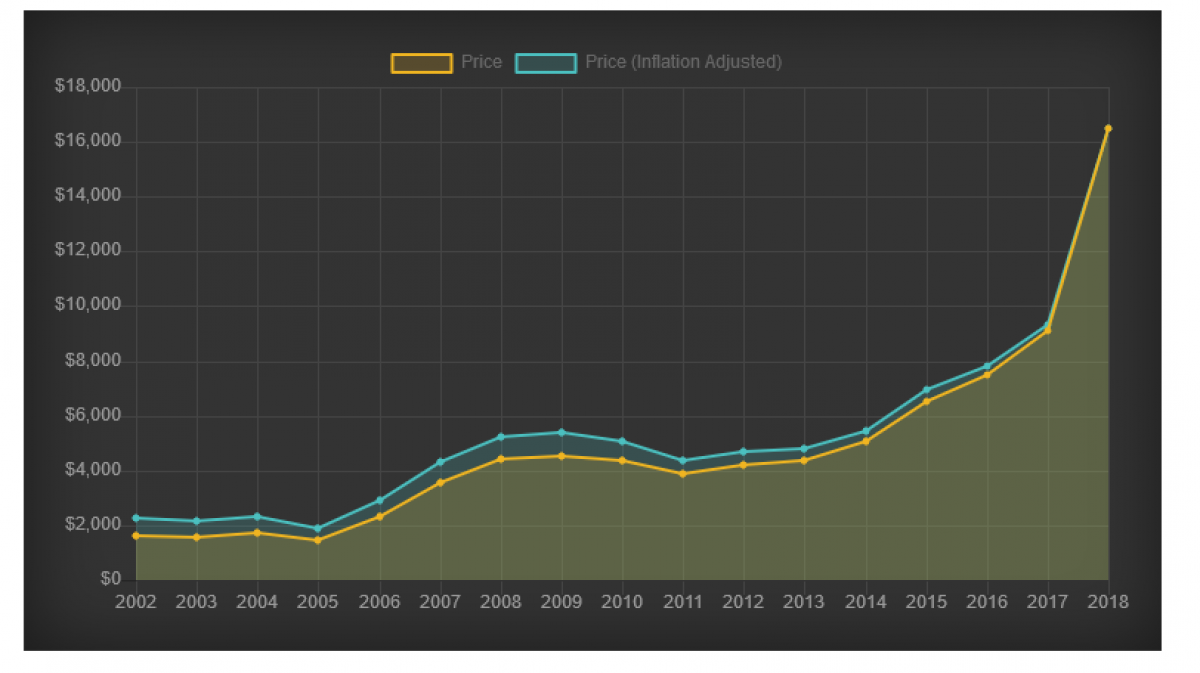

The lithium boom began in earnest in 2014, with prices rising from less than $6k a ton to more than $16k by 2018. With demand soaring, billions were invested in new mines, with salt brine deposits in Chile and China getting most of the attention.

IMG URL: https://d32r1sh890xpii.cloudfront.net/tinymce/2019-04/1556136208-o_1d98f497tatj1o9ntfic381gko8.png

Advertisement

But after a few banner years, Wall Street started looking at Lithium with more suspicion. In February 2018 Morgan Stanley issued a crushing report: the firm determined that Chilean brine would add 200kt to the market by 2025, effectively doubling supply.

That sent lithium prices plummeting. In China, lithium carbonate prices fell by 50.31%, crushed by reports of the over-supply.

Discuss in our Forums

See what other readers are saying about this article!

Click here to read & post comments.

3 posts so far.