Naturally this is not always the case - mining men are usually hardliners, and I would expect Hugh Morgan to be among the hawks at today's meeting.

Geopolitical pressures mean that the price of oil has lurched upwards by around $US16 a barrel since the low point of $US50.50 on January 19. This will be used both by hawks and doves - the hawks because price rises will increase oil price inflation and at some stage this will spill into other prices (including wages) and the doves because higher fuel prices will dampen household and business spending. And they will make the case this is equivalent in its effects to monetary tightening.

The doves will also point to weaker economic news from the US economy and rises in the value of the Aussie dollar.

Advertisement

As to the US economy, last week US Fed chairman Ben Bernanke explained his views to Congress - the appropriate but indirect way to communicate with market participants, incidentally. He made the point that the state of US growth and inflation is bedevilled at present by more uncertainty than usual. He was, however, at pains to point out that the Fed retains its vigilance against inflation.

Is the rising Aussie dollar a reason for holding back on interest rate hikes? In the 1980s RBA governor RA (Rob) Johnston used to argue that a rising exchange rate was effectively a "tightening of monetary conditions". This led the Reserve to go easy on monetary policy at some vital times, and this in turn led to an overheated boom, rising inflation, eventual large interest rate hikes and then the "recession we had to have".

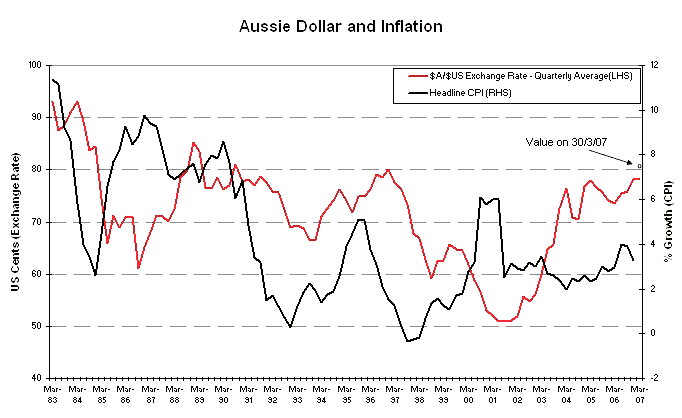

For this reason the Reserve nowadays tries not to be deflected by the state of the currency. But this matter is not just based on memories of burnt fingers. Consider the graph above.

If a strong dollar reduced CPI inflation, one would expect a negative correlation.

A rising dollar certainly helps contain inflation, but there is a lot of research that says this effect is small and hard to detect. There is no obvious negative correlation between CPI inflation and the value of the Aussie dollar.

Instead, there is a lagged positive correlation. This suggests that the main causation runs from inflation to the currency.

Advertisement

This is because high inflation makes the RBA raise interest rates and this (ceteris paribus) puts the currency up, and vice versa.

Positive correlation with a lag is the right interpretation of this graph. The only exception is at GST time, when (I assert) market participants for a time expected the coalition would lose the GST election and marked the dollar down despite high headline inflation.

We have disposed of the two main arguments of the doves. There are strong arguments for the hawks. The Reserve should raise cash rates tomorrow by 25 basis points.

If they do not, inflationary pressures will continue to build in the Australian economy.

First published in The Australian and on Henry Thornton's website on April 3, 2007

Discuss in our Forums

See what other readers are saying about this article!

Click here to read & post comments.