The work of the Reserve Bank is over for the year. Having failed to follow Henry Thornton's advice to provide a pre-emptive 50 basis point rate hike in November, now the wait is on to see if the 25 basis point hike actually implemented proves sufficient. Henry's hypothesis is that inflation is now out of the comfort zone.

There will be no further rate hike announced tomorrow as that would signal that last month's decision was too cautious. Short of an extraordinary turn of events, the board of the Reserve will not meet again until Tuesday, February 6. There will be plenty of time for careful reflection over the holiday season. The December-quarter Consumer Price Index - the main economic statistic in the rate-setting business - will be available by then (due out on January 24) to provide a clear test of the inflationary hypothesis.

There is no great amount of fresh news from the global economic scene. The Chinese boom continues unabated, Japan and the Asian Tiger economies are doing well, Euroland chugs along in second gear. The US has provided most of the excitement, with housing activity low, retail sales subdued and inflation creeping up. Commodity prices important to Australia rose further in November.

Advertisement

The swing to the Democratic Party in the US congressional elections has eased the geo-political risks as the Republican tactics in the war on terror have already been revised in favour of old-style diplomacy. Iraq is sliding into intractable civil war, and America is beginning the difficult debate of how best to disengage. The price of oil fell below $US60 a barrel but in recent days has risen again.

The Australian economy is appropriately described as robust despite the three rate hikes this year and the undeniable facts of serious drought in the rural areas and subdued activity in the old manufacturing centres.

The mining and services booms (the latter fed by Australia's regulatory overkill) continue unabated. This is the dilemma for policy-makers - the two-speed economy makes overall control far more difficult than suggested in economics 101.

For monetary policy, however, the crucial challenge is to keep the lid on inflation. In judging what is needed to achieve this, it is the overall state of the economy that is relevant. Retail sales rose 0.8 per cent from September driven by low unemployment, reduced petrol prices and the Government's May tax cuts.

In the year to October, growth was a strong 6.6 per cent, or over 3 per cent in "real", that is, inflation adjusted, terms. This is hardly indicative of an economy in distress.

Adding to the picture of a strong overall economy were the latest investment statistics - according to ABS estimates, companies boosted their capital spending plans for the year to June 30 by 9.8 per cent from the equivalent estimate three months ago.

Advertisement

Much of this booming investment is of course linked to the ongoing commodity boom. To return to an old problem, the trade deficit ballooned out to $1.26 billion in October, from a revised $728 million in September.

The main drivers behind the significant deficit were increasing imports of machinery and consumer goods, which easily outpaced minor gains in mining exports. Australia's international debt continues to rise inexorably, and it seems no one but Henry cares.

According to RBA statistics, lending to Australian consumers and businesses by banks and other financial institutions rose by 1.1 per cent in October from September.

Lending to businesses climbed 1.6 per cent, equalling the highest growth rate of the past year, while lending to consumers was substantially lower at around one half of 1 per cent.

For the year to October, total credit rose by 14.7 per cent. Lending to business grew by 16.7 per cent, while lending to households was up by around 12 per cent.

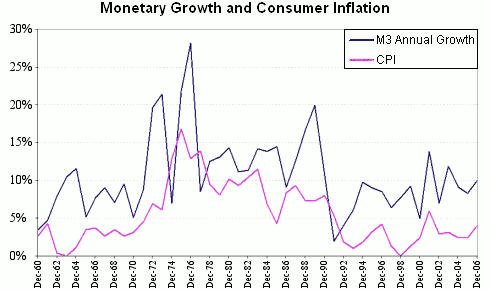

It has been argued that slower growth of household credit is a comforting statistic while the much faster growth of lending to business reflects sensible balance sheet management by businesses. The graph shows the relationship between consumer inflation and a measure of growth of the money supply.

The imperfect correlation here involves causes running in both directions and other forces impacting on both time series.

Nevertheless we need always to keep in mind the late Milton Friedman's view that inflation is everywhere and always a monetary phenomenon. As the graph shows, both series are turning up in Australia now, an ominous sign for any responsible central banker.

There has been little news on inflation, excepting a fine paper from Tony Richards, the head of economic analysis at the Reserve.

Richards examines measures of inflation that Henry had not previously heard of, reminding him of the intricacies of modern cosmological theory.

This fine forensic exercise did not, however, shake the plain man's view that inflation is higher than it should be, and in "underlying" terms is rising to a level near the top of the Reserve's target range.

Further, if one looks at the "25 per cent trimmed mean" measure preferred by Richards, underlying inflation is sharply up in the US and more gradually up in Euroland and Japan. Henry would be prepared to bet that such a measure would also be well up from its deflationary low in China, which as outlined last month indicates a far harder climate for containing inflation than the Reserve has faced for more than a decade.

The Melbourne Institute reported a rise in inflationary expectations of Australia's consumers, from 3.4 per cent in the year to September to 4.0 per cent in the year to October. This is another unsurprising but nevertheless worrying development.

Drought and the lagged effects of the interest rate hike so far will reduce the overall growth of the Australian economy, at least relative to what it was set to be. Whether it reduces it sufficiently to restrain inflation without further rate hikes is the great question.

No one, not even Treasurer Peter Costello or Reserve Bank governor Glenn Stevens, can be confident about the answer. There will be continued focus on the possible need to keep raising interest rates well into 2007. This will be a negative factor for the Government.

The assumption of a slower economy is plausible, and this will limit the Government's ability to offer electoral bribes or even to announce an economically responsible program of tax reform. Fortunately for the Government, however, the new Labor leader, Kevin Rudd, is not exactly well qualified to fight effectively on economic policy.