Escalation of violence in the Middle East has been the big issue over the past month. This pushed the price of oil perilously close to $US80 a barrel, although there has been some subsequent slight easing. Events there are horrible enough but could become much worse.

The Australian economy continues to "power on", to repeat the theme of the previous article in this series. The fresh news was the shocking growth of producer prices in the June quarter and then the correspondingly bad result for consumer prices.

Monetary policy needs to be tightened further and probably will be this month. How many more rate hikes will be needed is the crucial question.

Advertisement

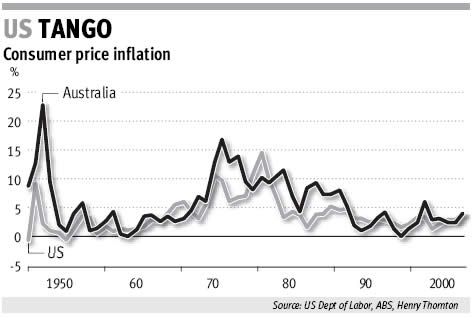

The accompanying graph provides important perspective. It tracks US and Australian consumer inflation since 1950.

The general similarity of the two series illustrates that inflation is a global disease. In the late 1960s, US inflation led inflation up everywhere. The Whitlam Government added its own inflation, and Australia quickly became a tragic economic disaster zone.

US inflation was cut earlier and more decisively than Australian inflation, but both came down to a low point in the past half decade.

Inflation has been rising in Australia and the US for several years and there is an obvious danger that this trend will persist and get worse.

Looking first at the international scene, China's too-strong, second-quarter growth (estimated at an annual rate of 11.3 per cent) and signs of domestic inflation were followed by the announcement of further monetary policy tightening.

Advertisement

Japan's recovery was confirmed and the Bank of Japan lifted interest rates from the zero levels that have prevailed for many years.

The US economy showed some signs of slowing, especially from the unusually high first-quarter outcome, but the US Fed continued to tighten US monetary policy.

Chairman Ben Bernanke's latest statement on monetary policy, however, contained some soothing words to the effect that, notwithstanding inflation higher than earlier expected, "the anticipated moderation in economic growth now seems to be under way", as evidenced by the slowdown in consumer spending and weakness in the housing market.

US and global equity markets rallied in the following days, although the main market themes continue to be skittish investors and volatile markets.

Events in the Middle East could yet go badly wrong. Hezbollah's attack on Israel is widely seen as an attack by proxy from Syria and Iran. The situation in Afghanistan and Iraq remains parlous. The failure of the Doha round of talks aimed at freeing world trade was another setback for the cause of liberal economic reform but will not have much immediate effect.

In Australia, the list of developments supporting the already strong case for monetary policy tightening is impressive.

- Consumer inflation in the year to June reached 4 per cent. This was of course affected in particular by the high price of oil and some other commodities, including bananas. Even the Reserve Bank's preferred measures of "underlying" inflation, the "trimmed mean" and the "weighted median", are rising and average just a tad below 3 per cent in the year to June.

- Producer prices rose by 4.5 per cent in the year to June, noticeably above expectations.

- Costs are beginning to escalate, especially in mining, but many government officials are also achieving strong wage settlements.

The saving grace is the new IR legislation that has encouraged stronger demand for labour but also (Henry assumes) strong increases in labour productivity.

- Unemployment is at a 30-year low and businesses report shortages of labour of all sorts.

- Business fixed investment is growing strongly, again especially in mining, adding to pressures on demand for labour and offering the promise of stronger export growth before long. This will be a great relief to policy advisers as Australia's current account deficit (CAD) cannot continue to exceed 6 per cent of GDP for much longer without international market participants enforcing financial discipline in the form of a lower Aussie dollar and higher Aussie interest rates.

- Australia's terms of trade remain high and may yet rise further from current levels. This means incomes are rising faster than production and this supports overall demand, but this cannot go on forever, not even for a potential energy superpower.

- Credit growth is accelerating, particularly for businesses, to a rate that Henry believes to be close to being unsustainable.

- Generous tax cuts have supported consumer demand despite expensive petrol. However, retail demand has been sluggish, a welcome fact in view of all the other pressures on demand in the Australian economy. A consumer boom at this point would provide serious risks to inflation and the balance of payments, and this should be the decisive argument for raising interest rates following today's meeting of the board of the Reserve Bank.

- Finally, markets are expecting a rate hike, with the relevant "market probability" quickly rising to virtually 100 per cent following last Wednesday's CPI release. Markets hate surprises and it is one of Ian Macfarlane's achievements to have presided over largely unsurprised markets.

What could stay the Reserve's hand? First, the Treasurer has renewed his anti-rate-hike jawboning, most recently suggesting the RBA should "look through" the effects of price hikes in things like petrol and bananas.

In the early 1970s Treasury and the treasurer similarly misdiagnosed the causes of rising inflation - and failed to tighten monetary policy - and this was an important precursor to the election of Australia's most economically illiterate government.

Related to this, there is the Glenn Stevens factor, which if the data were at all ambiguous might cause the board to hold back. But the data are not in the slightest bit ambiguous, and it would be risky in the extreme to allow the economy, and inflation, to run free at this time.

Finally, there is the possibility of a major deterioration in the geopolitical climate. "I suppose a nuclear bomb dropped on Tehran might give them cause to pause," an old hand said late last week.

Obviously we fervently hope this does not occur. Short of a stunningly bad geopolitical event, the real question is how many rate hikes will be necessary. Delay so far will again mean interest rates will be higher than would otherwise have been necessary.

We shall very likely know more tomorrow when the Reserve raises rates and offers a short explanation. Even if this is not the case, Friday will see the next monetary policy statement, when all will be revealed.