The Australian economy is set to continue its strong growth. It has shrugged off a period of weakness, unemployment keeps falling, business investment is surging and consumers are spending again. Monetary policy needs to be tightened.

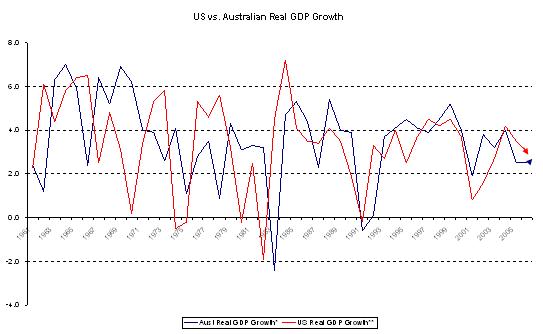

The graph shows US and Australian Gross Domestic Product growth. Notice how the early lead-lag relationship has become more or less simultaneous. Henry's hypothesis is that it is an aspect of globalisation - 40 years ago the US economy dominated Australia's business cycle, now both economies respond to global pressures.

Just before mid-May, global markets experienced a period of severe volatility. Resource equities and emerging market equities fell by amounts that varied from 20 per cent to almost 30 per cent. The most important reason seemed to be apparent inconsistency in new US Fed chairman Ben Bernanke's views about inflation. He started his reign as a supposed anti-inflation hawk but spoke of being "misunderstood" to an attractive lady journalist, then had to hose down the speculation created by that partial retraction.

Advertisement

When the dust had settled, Bernanke's concerns about inflation were clear. But, apparently, some of his Federal Open Market Committee colleagues felt he had pre-empted their decision-making and made strong speeches themselves.

The Fed's late June policy statement was softer than expected and markets rallied.

There are lessons here for the incoming Reserve Bank of Australia governor. The gossip has had deputy governor Glenn Stevens as clear favourite.

But in the second half of June, the name of Treasury Secretary Ken Henry has been mentioned as an alternative candidate.

One is led to ask why might the Treasurer be looking for an alternative to the estimable Mr Stevens?

There is always the possibility that Stevens spoke out too bravely on some policy issue, a known way for officials to limit their career prospects. It was the aggravation resulting from the Banana Republic episode as well as the excessive later tightening of monetary policy that led Paul Keating to appoint Treasury secretary Bernie Fraser as RBA governor.

Advertisement

There is also the obvious fact that Treasury secretaries tend to be closer to treasurers than are deputy governors. If you were treasurer and thought Glenn Stevens might be inclined to raise interest rates faster and further than Ken Henry, who would you appoint?

Also, a treasury secretary is always likely to be interested in a job he would sensibly regard as less taxing (no pun intended) and more fun - dinners in Basle have to be experienced to be believed.

We shall await the relevant announcement. Meanwhile, what has been happening in the real world? Volatile markets have eventually settled, although continued aftershocks cannot be ruled out. As the dust has settled it has become clear that global demand is still growing too strongly for comfort and that global interest rates are more likely to rise than to fall in the remainder of 2006.

Commodity demand is thought likely to remain strong, even if in time new supplies may reduce some commodity prices. The price of oil had by mid-June breached the $US70 mark for long enough that international agencies and central banks became concerned enough to begin to talk about the need to tighten monetary policy.

China's contribution to this debate was to raise slightly bank reserve ratios. The most sensible interpretation of this, incidentally, is that it is designed to prevent further acceleration of China's growth rather than to slow growth absolutely.

So, the prospect is for continued strong demand for Australian exports, and strong investment by mining companies is beginning to create additional supply. The terms of trade may fall away a bit more (as they did in the March quarter) but they will remain high.

Within the Australian economy most of the economic statistics have been suggesting strength rather than weakness. Housing activity is picking up and it now seems the low point here was in the December quarter. Except in Sydney, the weakness of house prices may be over. In Western Australia, the housing boom has continued unabated.

Consumer confidence has recovered somewhat as memories of the most recent interest rate hike fade, and retail spending will soon be strong again.

Government spending is everywhere strong. Wages of public servants are marching strongly up, exceeded only by wage hikes in the mining sector. Overall wages growth is ratcheting up, but not to such an extent that improved productivity might not outweigh its effects on inflation. Most spectacular has been the reduction in the official rate of unemployment to below 5 per cent.

In Henry's view, this is a clear sign that the new industrial relations laws are encouraging job creation, by making it easier to fire non--performers.

Henry's many contacts in the business world report that their workers are more productive, sometimes noticeably so.

Against this there is a clear overall rise in CPI inflation. Most of the rise can be attributed to high petrol prices, and in the early part of 2006 this was seen as a reason not to panic.

But the international brotherhood of central bankers has decided dear oil might be persistent, and the Reserve Bank cannot ignore this opinion.

This explains May's rate hike, which at the time was widely assumed to end the debate here.

However, as general consumer demand revives, housing begins to pick up on top of strong business investment and strong government spending, the case for at least one more rate increase will become compelling.

Henry has no doubt that Ian Macfarlane will be seeking to hold off a further rate rise until his loyal deputy gets the nod as his successor. Post such a decision there would be a more or less immediate rate hike, with a second one to come once Stevens was firmly in the driver's seat.

Henry will get no thanks for saying so, but Stevens is far more of a traditional central banker than Ian Macfarlane, or Ken Henry for that matter.

Should Ken Henry get the job, a second rate hike would be far less likely. But a steady rise of domestic inflationary pressure would be correspondingly more likely. Eventually, of course, the pressures to hike rates would overwhelm Dr Henry's natural soft-hearted instincts, since as Reserve Bank governor he would not wish to be remembered as the man who gave away Australia's low-inflation reputation.

The Treasurer's judgment about the RBA governor is likely to depend on whether, or indeed when, he hopes to contest an election as prime minister.