Whether an intensified resource boom would help cure the current account deficit is very much open to debate. The current large trade disequilibrium is a clear sign that Australian industry is not especially competitive: indeed in some sectors we are downright uncompetitive. And there is clear evidence of major bottlenecks in the resource sector. Increased investment is underway to reduce these bottlenecks but this will take time to have its effect. The worst case is that additional capacity comes on-stream at about the time of the next global slump.

One particular commodity, oil, has the capacity to precipitate a global slump on its own. The price of oil has been ratcheting up in a series of increases and decreases with so far little measurable impact on the world economy. The grim situation involving Iran, the ongoing struggle in Iraq and the election of Hamas in Palestine all raise tensions in an area that contains a lot of the world’s oil supplies. How the global economy would cope with oil at US$100 per barrel is uncertain, but at some point in such a scenario central bankers may hike rates too high, or consumers in Western nations may retreat into their shells of their own accord and the current global boom would slow substantially or even go into reverse.

Even without a geopolitical crisis, sharp falls in over-priced Western and Chinese real estate would also test the strength of the current global boom. Real estate collapse is a low probability event because global monetary policy is still not tight, but would be a complicating factor in any recession created by dear oil.

Advertisement

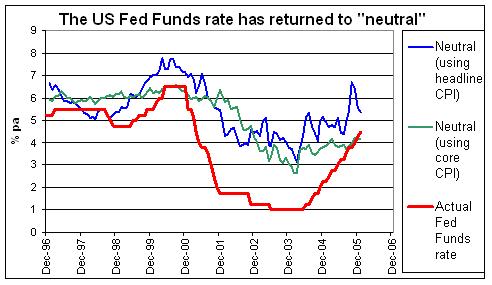

Ben Bernanke’s elevation is an extra risk. Monetary policy has at last returned to neutral in the US. Throughout the first five years of this century, and the last five of Greenspan’s chairmanship, monetary policy had been extremely accommodative (see chart). We show this by comparing the actual Fed Funds rate with our proxy for the neutral rate. The “neutral” level of cash rates is measured as the sum of the inflation rate (either headline or core) and the real interest rate, which is the yield on inflation-indexed bonds.

Actual interest rates in the US have been well below “neutral” - the rate that neither stimulates nor restricts economic affairs - for several years. But now after 14 consecutive 0.25 basis point well-signalled rate rises, monetary policy in the US is no longer stimulative. If Ben Bernanke were to actually tighten, which he might in order to prove his credentials as an inflation-fighter or if capacity utilisation or oil prices rise further, the new ball game becomes very much more dangerous for whoever is governor, and more importantly for the Australian economy.

Our criticism of Ian Macfarlane’s stewardship of the Reserve Bank is that it has left Australian industry far less competitive than it should be, and less wealthier because of the mediocre currency value of the Australian dollar as it moves to balance the external accounts with a massive current account deficit. How an uncompetitive industrial structure copes with the surprises that shall be thrown up over the next few years will be the ultimate test of Macfarlane’s Reserve Bank.

Source: Henry Thornton.com, Bloomberg Data.

Discuss in our Forums

See what other readers are saying about this article!

Click here to read & post comments.

8 posts so far.