The ASX might be concerned that they would lose business with sunlight trading as companies would decide to list their shares on other exchanges. This might well be the case for those companies whose officers wish to take advantage of inside information. However, I would argue that the opposite result could occur with overseas companies seeking a listing in Australia, so they could protect their shareholders from insider traders and prevent their employees from unfairly taking advantage of outsiders. Sunlight trading by the ASX would make Australia a world leader in establishing ethical investing with a truly transparent market place with its integrity safeguarded on a market driven self-enforcing basis.

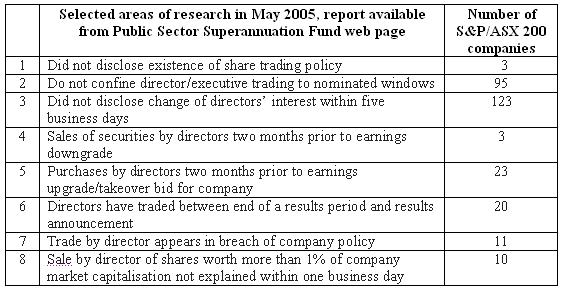

All the current rules and rituals of directors and officers trading shares could be eliminated. The current rules give false comfort and are expensive meaningless distractions. These rules provide the basis for the BT report as set out in the table below that was obtained from the website of the Public Sector Superannuation fund, a sponsor of the study.

Public Sector Superannuation Fund web page here.

Advertisement

Confining share trading to nominated trading “windows” as noted in row 2 in the table does not protect outsiders from insiders with superior information. Sunlight trading would allow directors and insiders to continuous trade at any time of the year to create a much more liquid and informed market. Similarly, disclosing director trading five days after the event as noted in row 3 of the table does not protect the uninformed counter party to the trade. There are many other insiders beside directors that the report did not investigate. All these other types of traders would need to disclose if they had privileged information to avoid the risk of being sued when the inside information was made public to allow insiders to be exposed to being identified.

A simple solution would be for the government to cancel the ASX operating licence and require all Australian shares to be traded on E-Bay. E-Bay not only requires disclosure by participants of themselves and what they know about the goods being offered but it also outlines their trading history. In addition E-Bay allows counter parties to rate their satisfaction in how the quality of the goods traded matched the description of the seller.

Sunlight trading not only provides far greater protection for investors and traders but creates a much fairer and efficient market. It avoids the cost of ineffectual monitoring of market activities. Its time that market ideologues walked the talk to privatise both monitoring and corrective action of insider trading.

His submission to the Australian Senate Inquiry into “The framework of the market supervision of Australia's stock exchanges” of February 5, 2001 is posted here. This article was first published on Henry Thornton on November 16, 2005.

Discuss in our Forums

See what other readers are saying about this article!

Click here to read & post comments.

3 posts so far.