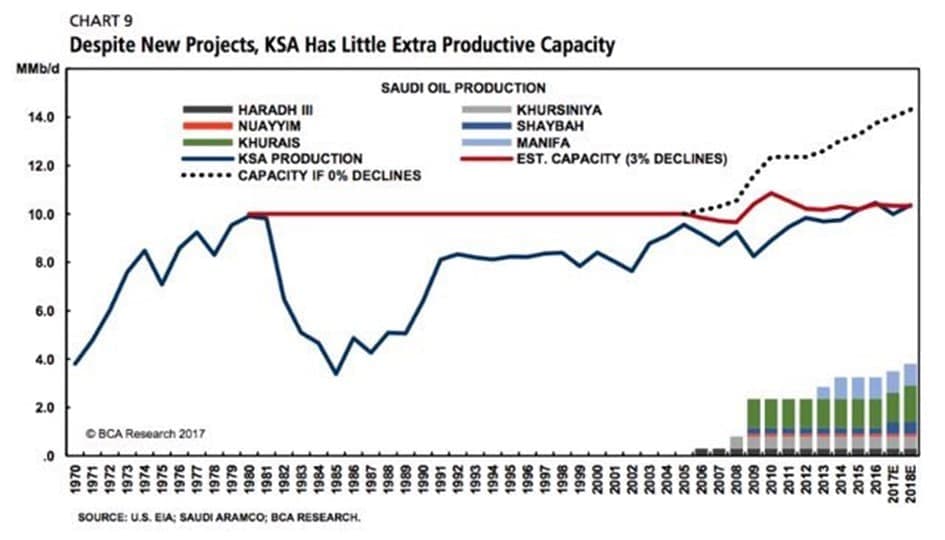

When these questions are not being addressed, but become reality, OPEC’s upcoming meeting will be put in another light. Without a real spare production capacity, or with a much lower capacity, the current discussion is null and void. Additional oil on the market will be constrained, leaving a ceterus paribus situation, with increased threats from Venezuela and Iran.

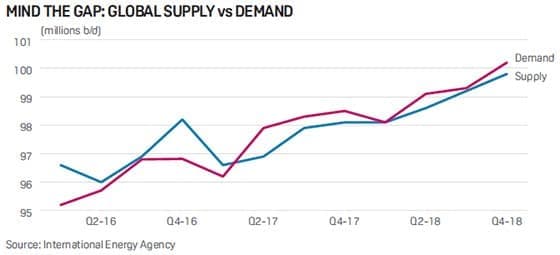

As U.S. bank Goldman Sachs already indicated, demand for crude oil and products is not showing any real slowdown. If production cuts stay in place, markets will tighten at an even faster pace.

Advertisement

Despite the still elevated inventories and a small supply overhang, the Russia/OPEC mission has been mostly accomplished. A healthy appetite for crude, combined with an unexpected high level of compliance (or forced compliance in Venezuela’s or Libya’s case), has stabilized markets. Demand, as reported by all institutions and market watchers, is expected to be robust. The threat of higher oil prices culling demand is still very low, but will be looming on the horizon. For 2018-2019, no real risks exist for an oil price showdown. Without a real global financial crisis, lights are on green for a tight crude oil market for an extended period of time. OPEC’s Vienna meeting will not trigger a new oil glut. Some goodwill gestures might be expected, such as the use of Saudi’s floating storage, but in reality no options exist to move anything. Without major new investments outside of Saudi Arabia or the GCC region, the world is heading for higher prices long-term. Counting on Saudi Arabia’s spare capacity could be foolish.

Discuss in our Forums

See what other readers are saying about this article!

Click here to read & post comments.

5 posts so far.